NEW YORK (CNN/Money) -

ABN Amro Holding NV said Monday it is closing its U.S. equities and merger and acquisitions businesses and cutting more than 500 jobs.

The Dutch bank closed the operations, which it called "relatively small and competitively weak," after a difficult year that saw downturns in the global economy and U.S. stock markets. It will focus on building its U.S. wholesale banking business.

"We are withdrawing from purely domestic wholesale activities, which are both loss-making and not oriented to the cross-border needs of our target clients," said Wilco Jiskoot, chairman of the bank's Wholesale Clients division. "The decision to close some of our operations in New York has not been easy, but it is necessary -- not only in light of market conditions, but to support the focused wholesale banking strategy we are pursuing."

About 550 jobs in trading, research, sales and related support functions will be lost. The restructuring will cost  205 million (about $180 million) after taxes, over two years. 205 million (about $180 million) after taxes, over two years.

The bank said the shutdown will lead to "significant improvement" in the profitability of its U.S. banking operations in the next three years. It also said it is keeping and expanding its prime brokerage and futures and options businesses, which it called key reasons for its acquisition of ING Barings' U.S. operations in April 2001.

| |

Related links

Related links

| |

| | |

| | |

|

ABN Amro had a difficult year across all of its operations in 2001, hurt by the economic slowdown, bad loans, the Sept. 11 attacks and other factors. It cut about 7,000 jobs and saw its profit fall about 15 percent during the year.

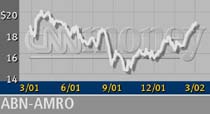

ABN (ABN: Research, Estimates) shares rose 6 cents Friday to close at $19.26.

|