NEW YORK (CNN/Money) -

Americans never really stopped spending during the recession, and the latest economic signals indicate they're not about to stop. That's a welcome relief to retailers coming off one of the most dismal years in recent memory.

Americans spent more money in February -- 0.6 percent more -- compared with January, the Commerce Department reported Friday. Additionally, personal income also increased, and Americans saved at the highest rate since September.

The upbeat spending report, coupled with consumer confidence, which soared this week to its highest level since August, 2001, and a robust housing sector mean that consumer spending is not about to retreat, analysts said.

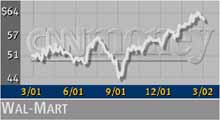

However, there is also no evidence that department stores, which lost market share to discount chains last year, are set for a rebound even if consumers feel more confident about their jobs and have more money to spend, analysts said. They noted that chains such as Wal-Mart Stores Inc. (WMT: Research, Estimates) and Target Corp. (TGT: Research, Estimates) have won over consumers with everyday low prices and convenience while department stores and specialty chains continue to struggle.

Still, sales should improve all around in 2002.

"Basically everyone is going to enjoy better sales than they did last year," said Scott Krugman, a spokesman for the National Retail Federation.

Wall Street buys into that view, and anticipates higher profits for the entire sector, thanks to the relatively sluggish sales and earnings figures of 2001 and a rebounding economy.

Retailers are expected to post a 15.4 percent rise in first quarter earnings compared with a year earlier, according to earnings tracker First Call. For the full year, retailers' profits are forecast to grow 20.6 percent from a year ago, far ahead of the minuscule 1 percent year-over-year increase the group recorded in 2001.

Department stores, hurt by sluggish apparel sales and margin-eroding discounts, are expected to see a 14 percent jump in first-quarter earnings followed by year-over-year increases of 37 percent and 50 percent for the second and third quarters, according to First Call.

However, the strength of the department store numbers is more indicative of cost-cutting rather than improved sales and a stronger economy, First Call analyst Ken Perkins said.

"I wouldn't read this at all as a shift in consumer trends,''Perkins said. "Discounters are benefiting from a weak economy and they have been taking market share from department stores."

Apparel sales, on which traditional department stores largely rely, are still lagging despite an early Easter that is expected to bring a seasonal boost. Federated Department Stores, (FD: Research, Estimates) owner of Macy's and Bloomingdale's, May Department Stores (MAY: Research, Estimates), owner of Lord & Taylor and Filene's, and Dillard's (DDS: Research, Estimates) all have been struggling with declining sales and heavy discounting as they slash costs to save the bottom line.

"A good economy isn't an automatic fixer for department stores," Krugman said. "To attract customers they need to differentiate themselves. They aren't doing that right now."

Kurt Barnard, president of Barnard's Retail Consulting Group, said department stores are also suffering from a stale image in the eyes of a new generation of consumers brought up shopping at Wal-Mart, Target and other chains.

"It is really a question the perception consumers have of the department store as old and fuddy duddy," Barnard said. "The department store is traditionally the domain of older people, and these people are not changing their habits. Meanwhile, younger consumers are being weaned in discount chains. That leaves the department stores in one hell of a bit of mud."

"The discounters are just continuing to outperform every other sales category on a monthly basis," said Malachy Kavanaugh, a spokesman for the International Council of Shopping Centers. "They've just ingrained themselves in the consciousness of American consumers. They're the first choice for Americans to go shopping for a lot of items."

Though the numbers point to a boost for retail this year, there are still some signs of uncertainty. The short-lived recession, helped along by the Sept. 11 terrorist attacks, hurt consumer spending and forced many retailers into offering steep discounts and promotions, often at the expense of profitability, just so they didn't get stuck with merchandise.

Click here for retail stocks

Now, Americans are trained to expect big bargains, and will often hold off until they find a sale.

Additionally, mortgage rates are back on the rise, ending a refinancing boom. Americans are also overloaded with debt thanks to new mortgages and credit card purchases, analysts said.

The bottom line is that investors thinking about retail need to evaluate each company on its own rather than simply group them into a category, said Alan Ackerman, market strategist at Fahnestock & Co.

For instance, department stores may be struggling, but J.C. Penney Inc. (JCP: Research, Estimates) has been staging a turnaround under CEO Alan Questrom that has netted it improved sales at stores open at least a year, a key industry gauge known as same-store sales. And Kohl's Corp. (KSS: Research, Estimates) has managed to post double-digit sales gains each month without sacrificing margins.

Discount chains may be leading the sector, but the fierce competition and poor store execution sent Kmart Corp. (KM: Research, Estimates) into bankruptcy in January.

And specialty apparel chains such as Gap Inc. (GPS: Research, Estimates) are struggling, while others such as American Eagle have fared somewhat better, analysts have said.

"I think for the moment the big chains are running like elephants. They tend to be behind the cheetahs and the panthers," Ackerman said of department stores. "I think they lumber along, and I think this is not necessarily the time to move. I think the turnaround isn't going to be as routine or orderly as you might expect. I'd want to stay with the strength right now."

|