NEW YORK (CNN/Money) -

Adelphia Communications Corp. asked the Securities & Exchange Commission for extra time to file its annual report Monday, the same day a published report said the cable TV company was considering selling off some of its assets in the wake of disclosures of billions in off-balance-sheet debt.

The Coudersport, Pa.-based company, which is the sixth-largest U.S. cable provider, said it and its auditors needed extra time to consider ways to explain some of its debt to shareholders. Its stock plunged last week on revelations that it was liable for about $2.3 billion in off-balance-sheet debt.

"We recognize that in the current financial environment, shareholders are looking for greater clarity and transparency from the companies in which they choose to invest," said CEO John Rigas. "We at Adelphia recognize and respect that desire for greater clarity and transparency, and are committed to providing it in a timely manner.''

The Wall Street Journal said the company was considering plans to sell some of its assets after revealing last week that it was liable for debts incurred by partnerships owned by the Rigas family, which founded and continues to operate Adelphia. Some of the loans were used by the family to buy more Adelphia stock, according to a Reuters report last week. Adelphia did not return calls seeking comment.

Adelphia, which has about 6 million subscribers, also did not say who was auditing its annual report, but Deloitte & Touche LLP audited the company's past reports.

Among last week's revelations, Adelphia said it might be liable for $500 million in debt held by its former local telephone services unit Adelphia Business Solutions Inc. (ABIZ), which Adelphia spun off in January. ABIZ filed for Chapter 11 bankruptcy protection last week. Adelphia also said, in an 8-K filing with the SEC, that the involvement of the Rigas family in ABIZ could represent conflicts of interest and put strains on Adelphia executives.

| Related links

|

|

|

|

|

Adelphia has been working for weeks to pay off its debt, which totals more than $14 billion, to satisfy rating agencies, according to the Journal report. Off-balance-sheet debt is a particularly sensitive topic in the wake of the implosion of Enron Corp., which filed the largest bankruptcy in U.S. history last December. The energy trader was dragged down in part by debts held by off-balance-sheet "special purpose entities."

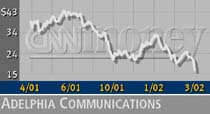

The latest news sent Adelphia (ADLAC: Research, Estimates) shares plunging nearly 15 percent Monday after losing nearly 30 percent in value last week.

|