NEW YORK (CNN/Money) -

Prudential auto analyst Michael Bruynesteyn downgraded Ford Motor Co. to a sell recommendation Monday, saying that management comments on the increasing costs of light trucks is a major concern.

The sell recommendation is still relatively rare among Wall Street analysts. Ford is the only company in the auto sector to have that rating by Prudential, and despite ongoing losses and gains by competitor General Motors Corp. only two other analysts out of 15 surveyed by First Call have a sell recommendation on the stock. By contrast, seven of those 15 analysts have a buy or strong buy rating on Ford, and the rest have a hold rating, as Prudential did before its downgrade. Prudential previously had a hold recommendation on Ford, as it does on competitors GM (GM: down $1.34 to $59.11, Research, Estimates) and DaimlerChrysler AG (DCX: Research, Estimates).

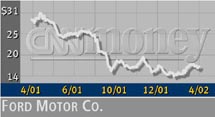

Shares of Ford (F: down $0.87 to $15.62, Research, Estimates) were down about 5 percent in morning trading Monday. Bruynesteyn's 12-month target price for the stock is $12, nearly 25 percent below current pricing.

Bruynesteyn also cut his earnings per share forecasts for Ford to 18 cents this year and 87 cents next year. First Call's EPS forecast for this year is only 13 cents, and the 2003 forecast is 95 cents.

The company had its first annual loss in nine years last year, and announced a broad restructuring plan in January that included plans to close plants and eliminate 35,000 jobs in the coming years.

Bruynesteyn's note to investors said his discussions with management confirmed that the new F-series pickup truck, the nation's best-selling vehicle, is growing more costly to build, as is the Expedition sport/utility vehicle.

| |

Related stories

Related stories

| |

| | |

| | |

|

"We cannot see a speedy recovery at Ford with costs rising and pricing flat on two of its most important trucks," Bruynesteyn's note said. "In addition, prior research we have done on production flexibility and the cadence of new products suggest that Ford will lose significant market share and make little progress in its turnaround before 2004.

Click here for a look at auto stocks

Ford said last week it is holding the price on the Expedition and a number of other new models. Ford Chief Financial Officer Martin Inglis also warned investors that while incentive costs are lower than in the fourth quarter they remain higher than budgeted.

|