NEW YORK (CNN/Money) -

The IRS, it seems, is up to its old tricks.

Over the last few years, fewer than 1 percent of tax returns have been targeted for audit, part of the 1998 Restructuring and Reform Act that demanded a kinder, gentler approach to taxpayer scrutiny. According to number crunchers on Capitol Hill, the legislation cost the government some $278 billion per year in lost tax collections due to fraud and filing mistakes.

But all that's about to change.

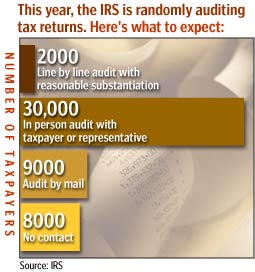

Eager to collect the cash gone missing from its coffers, the agency said it will reinstate a policy of random audits this year. Some 50,000 taxpayers will be targeted in a program desiged to help the Treasury Department update the formula it uses for audit selection.

Once the agency finishes its "National Research Program" -- the euphemistic name for this nationwide random audit -- it will use results to tweak a secret scoring system that flags returns for extra scrutiny. The payoff for Uncle Sam could be huge. Boosting collections by just 0.1 percent would bring in an additional $1 billion in tax collection revenue, according to government projections.

There's nothing you can do to avoid a random audit, of course. But there are plenty of red flags the agency is bound to pounce on during its routine checks this year. Smart taxpayers should play it safe. Here's how:

Report all income

It's a no-brainer, but individual taxpayers continue to land themselves in hot water because they omit key information about their income, said Martin Kaplan, a New York certified public accountant and co-author of "What the IRS Doesn't Want You to Know."

"For the last 35 years, the IRS has been checking income. You can be absolutely sure if you leave off a W-2 or an interest dividend or a 1099 you'll get an audit notice," said Kaplan. "If you leave out more than 25 percent of your income, it could be considered fraud."

|

| |

| | |

|

The gross tax gap [due to underpayment of taxes] was estimated at more than $278 billion, indicating ample room for improvement.

| |

| | |

|

| |

| | |

|

Internal Revenue Service on announcing its new audit program

| |

|

The reason the IRS zeros in on income? It's an easy way to bust people. That's because all those official documents that are provided to taxpayers -- be it W-2 wage forms, 1098 mortgage interest statements or proceeds for the sale of securities listed on a 1099 -- are also sent to the good folks at the IRS. Because there's a paper trail leading to your return, failing to report publicly-disseminated data is tantamount to putting an "audit me" sticker on your tax return.

When you file your taxes, be sure you've got all your documents in place. And keep an eye out for investments that are not tax-efficient and should be dumped or held in a sheltered account like a 401(k) or Roth IRA. For tips on tax-friendly investments, read "Funds that keep the IRS away."

Don't be greedy

You can't fudge the numbers on your W-2, but there is opportunity for unscrupulous taxpayers to skew numbers that aren't officially tallied by the likes of an employer or mortgage lender. That's especially true for individuals filing a Schedule A form, which lists such itemized deductions as unreimbursed business expenses, medical costs, charitable contributions and casualty losses.

Some folks conveniently forget that personal expenses don't qualify as legitimate write-offs. The IRS knows it and zeroes in on folks who itemize.

"I can tell you that when miscellaneous deductions start to resemble a significant deduction or include items for personal use, such as luxury items -- the IRS gets unusually excited," said Jeff Kelson, a tax partner with BDO Seidman.

What counts as a significant deduction? The IRS won't divulge what kind of tax break sets off an audit, but tax pros warn that individuals who claim deductions that exceed 30 percent of their adjusted gross income are venturing into risky territory.

"You have to have enough money left over to cover your expenses. Thirty percent is high," explained Tony Bardi, an enrolled agent with B&M Tax and Financial Services in Gresham, Ore. who represents clients in audits at IRS hearings.

Of course, no matter how much your deductions total, it's vital to keep careful records. If you give to charity, for example, keep a detailed list of your donations and a receipt from the organization acknowledging the fair market value of your gift. Be aware of the rules. You can only claim medical costs that exceed 7.5 percent of your adjusted gross income; unreimbursed work costs have to top 2 percent of AGI. For more information about deductions, see IRS Publication 501 and Publication 502.

If you've got unusually high deductions, it helps to attach a disclosure statement -- Form 8275 -- with your return instead of waiting for the IRS to contact you with questions.

Justify your numbers

Self-employed individuals and freelancers also have to be extra careful if they're filing a Schedule C showing profits or losses from their business.

|

| |

| | |

|

I think people in the $40,000 to $100,000 range do the most exaggerating [on their tax returns]. That's my opinion. When someone's in the $500,000 range, they hire a tax preparer. They don't care about a few thousand dollars; they're taking standard stuff.

| |

| | |

|

| |

| | |

|

Martin Kaplan

CPA and co-author "What the IRS Doesn't Want You to Know"

| |

|

"If you file a Schedule C, you're three times more likely to be audited than if you file a regular return," said Kaplan.

It goes without saying that Schedule C filers should justify their numbers with careful records. For example, individuals who use their car for work should keep a mileage log to justify the portion of vehicle expenses that can be attributed to their job vs. personal use. Hint: you'll have a difficult time convincing the IRS that 100 percent of your auto costs are work related.

The rules for home offices also are strict. If you're working from home a few days a week instead of commuting into work for personal convenience, you are not eligible for a home-office deduction. Don't forget to track income, too. Keep all receipts for any sales you make or work you do. And be prepared to explain big losses. You have to show that you're in business to make money or else the IRS will challenge your expenses as hobby costs.

One way to avoid trouble is to use the IRS's own resources, said Kaplan. He recommends that self-employed filers get copies of the so-called Market Segment Specialization Program (MSSP) guides put together by the government.

The guides are meant to help IRS agents identify the expenses and earnings that are typical to various professionals -- from taxi cab drivers to attorneys, architects and even ministers. But individuals can use them to learn what kind of things the IRS is scouting for. Some of the guides can be viewed on the IRS Web site or you can order them by calling (202) 512-1800.

Some tax pros recommend individuals separate work and personal accounts, and some even suggest that self-employed filers form a corporation or limited liability company so they can file a Schedule S.

Earn your earned income credit

Low-income individuals and families often qualify for the earned income credit, even if they don't owe taxes, but the formula for determining EIC eligibility is tricky. As a result, the EIC is a common source of filing mistakes -- and a credit that's invited fraud. Returns that claim the credit have attracted the notice of IRS auditors.

"For 1999 and 2000 returns, this was a hot item; the IRS felt people were abusing it," said Kelson. "Unfortunately, people who could qualify may not be aware of it."

The earned income credit for tax year 2001 is up to $2,428 for filers who have one child and up to $4,008 for two or more kids. The maximum credit for childless filers is $364. Individuals must have worked to qualify, and there are rules regarding what counts as income. (Pension money doesn't count, but investments over roughly $2,400 disqualify people for the credit.) For more information, go to the IRS web site and read "Tax Topics 601" and Publication 596.

For more details about tax breaks for families, read "Tax benefits and children."

Fix mistakes

So, what happens if you spot a mistake after you file -- or you get a case of the jitters because you've fudged some numbers? Filing an amended return will draw attention to you and it does increase your odds of an audit, say tax experts. That's because an IRS employee will have to examine your original filing against the new copy. That means anything that looks amiss may be flagged for further scrutiny.

But experts insist it's always best to come clean no matter what.

| |

RELATED STORIES

RELATED STORIES

| |

| | |

| | |

|

"If you find a mistake, you're now playing the lottery," said Martin Shenkman, a New York City tax attorney. "If they don't catch you, you're free. On the other hand, if they do catch you -- not only will you have to pay the tax, you'll have to pay interest and penalties. So file the amendment as soon as possible. Sometimes penalties can even be waived if you've shown a reasonable cause for an error."

You generally have three years to file an amended return. Use Form 1040X, which you can find on the IRS Web site. (Search for it under Forms and Publications.) Of course, if you want to avoid the hassle of fixing errors, consider hiring a tax adviser who will not only help you prepare your returns, but who also can help you do smart tax planning for the future. To learn more about the various services different tax experts offer, read "How to hire a tax pro."

Once you've filed your taxes, it's not too early to start thinking about your 2002 return. The new tax law brought lots of new breaks that take affect this year, so start to plan early. For some tips, see "Tips for 2002 tax returns."

|