NEW YORK (CNN/Money) -

Xerox Corp. will restate four years' worth of financial results and pay a $10 million fine, the company said Monday, to settle allegations of securities fraud brought by the Securities and Exchange Commission.

The company, known best for its copier products, said it agreed to restate financial results for 1997-2000 that could include more than $2 billion in revenue, and that it has filed papers with the SEC seeking permission to delay its 2001 annual report. The company will also adjust previously stated 2001 results.

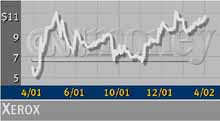

Xerox (XRX: up $0.33 to $11.08, Research, Estimates) stock jumped more than 3 percent in afternoon trading Monday after the announcement.

The fraud allegations relate to the way in which Xerox booked sales of equipment, service, supplies and financing by charging customers a single monthly price, which the SEC said did not comply with financial accounting standards. Xerox said it has since changed its methods.

CEO Anne Mulcahy said the settlement is the best option for the company and that Xerox is "best served by putting these issues with the SEC behind us and focusing on restoring...growth."

The revenue adjustments primarily reflect equipment sales. Additionally, the restatement will include adjustments that could exceed $300 million due to the establishment and release of certain reserves before 2001.

The agreement also calls for the SEC to file a complaint and consent order in federal district court for injunctive relief and a $10 million civil penalty. Xerox (XRX: up $0.33 to $11.08, Research, Estimates) said the settlement is not an acknowledgment of guilt.

The company said it is seeking SEC approval to delay the release of its annual report by 15 days, with the option to extend the deadline by an additional 75 days.

The SEC has been investigating questionable accounting practices at Xerox since June 2000. Last May, the company acknowledged it had uncovered some irregular accounting practices that did not comply with Generally Accepted Accounting Principles (GAAP) and that reduced shareholders' equity by $137 million and net worth by $76 million.

Xerox began settlement talks with the SEC's Division of Enforcement last month after the agency notified Xerox of plans to recommend action against the company for its alleged securities law violations.

|