NEW YORK (CNN/Money) -

U.S. Treasurys pushed higher Tuesday afternoon on the heels of a weaker-than-expected February factory orders report that clashed with the recent trend pointing to a sustained recovery in the manufacturing sector.

Around 5:00 p.m. ET, two-year notes were up 6/32 at 100, yielding 3.61 percent. Five-year notes were up 11/32 to 94-28/32 to yield 4.75 percent.

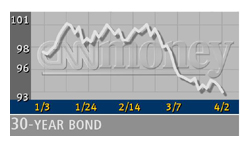

Benchmark 10-year notes rose 20/32 to 96-14/32, yielding 5.34 percent. Thirty-year bonds were up 28/32 to 94-17/32 to yield 5.76 percent.

February factory orders fell 0.1 percent, as weaker demand for computers and cars eclipsed gains for household appliances and industrial machinery. It marked the first drop in overall orders since November and followed a solid 1.2 percent advance in January, the Commerce Department reported Tuesday. Economists surveyed by Briefing.com on average expected a rise of 1.0 percent in February.

"February factory orders were much weaker than expected," said William Sullivan, senior economist and executive director at Morgan Stanley.

Sullivan said that while no one regarded the report as a watershed statistic, it forced investors to consider what the "contours" of the economy will be beyond the first quarter.

"We're looking for guidance on how the economy will fare later on. This figure suggests businesses are reluctant to make major spending commitments on equipment," he said.

Data released Monday showing expanding manufacturing activity fed fears that a strengthening economy would prompt Fed rate hikes -- maybe as soon as May.

John Spinello, fixed-income strategist at Merrill Lynch Government Securities, said the weaker tone of the economic data released Tuesday inspired some short-covering and spawned the notion that the Labor Department's monthly employment data, due this Friday, might not be as robust as forecast.

Economists polled by Briefing.com, on average, estimate that U.S. payrolls grew by 50,000 jobs in March after adding 66,000 jobs in February.

But traders said bond prices could stay in a tight range, arguing that Treasurys have already priced in a Federal Reserve tightening and therefore are unlikely to go much lower.

"Our market has four tightenings of 25 basis points each built in already, so we'll be in a tight range," said Vincent Verterano, head of governments trading at Nomura Securities International in New York.

Treasurys were lower in morning trade on increasing concerns about higher oil prices due to escalating tensions in the Middle East and continued evidence of a strengthening U.S. economy, expected to put pressure on longer-term bonds.

Verterano called the impact of higher oil prices a wash for the bond market.

"It's a trade-off," he said. "Higher oil prices cause a little inflation but they probably slow the economy somewhat. Gold's over $300 and the market's been yawning. Companies don't have a lot of pricing power so it probably impacts [corporate] earnings more than inflation."

The price of a barrel of light crude oil for May delivery surged above $28 a barrel in New York for the first time in six months Tuesday on continued speculation about potential instability in Middle East supplies.

Separately, Treasury Secretary Paul O'Neill urged Congress to raise the existing $5.95 trillion debt limit and said he would tap into the federal employees' retirement account from April 4 to April 18 to prevent the government from hitting the debt limit.

Dollar mixed against euro, yen

In the currency market, the yen was still under some pressure, having lost ground Monday after a disappointing survey of Japanese business sentiment subdued hopes of a rapid recovery.

Analysts said concerns over an oil embargo could hurt the dollar and the euro.

"There was a perceived threat about an oil embargo, which would be negative for the dollar because the U.S. is a major oil importer. But the market sees it as an unlikely scenario and the market has calmed down as liquidity returns," said Shahab Jalinoos, currency strategist at UBS Warburg.

"Rising oil prices will hurt the euro because of inflationary pressure and a reduction in eurozone purchasing power as a result. Europe is behind the U.S. in growth and a shock from higher oil prices will pose bigger damage," Jalinoos said.

Around 2:20 a.m. ET, the euro was quoted at 87.89 U.S. cents, down from 88.02 cents late Tuesday.

The dollar bought ¥133.28, down from ¥133.40 late Monday.

-- from staff and wire reports

|