NEW YORK (CNN/Money) -

Quest Diagnostics Inc. is buying Unilab Corp. in a stock and cash deal worth that will pay Unilab shareholders a premium of less than 8 percent.

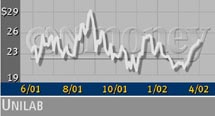

The deal is valued at $1.1 billion, including the assumption of $200 million in Unilab debt. Under terms of the deal Unilab shareholders can elect to receive either .3256 shares of Quest stock or $26.50 in cash for each share, although Quest's cash payments will be limited to 30 percent of the payment price. Based on Monday's closing price the Quest stock is worth about $29.96 for each Unilab share.

Shares of Unilab (ULAB: Research, Estimates) gained 41 cents to $25 in trading Monday, while shares of Quest (DGX: Research, Estimates) lost 6 cents to $82.79.

Quest is the nation's largest provider of medical diagnostic testing, information and services, while Unilab is a leading provider of diagnostic testing in California. Unilab reported 2001 revenues of $390 million and has about 4,000 employees. Quest said the deal should add to 2002 earnings per share, excluding charges related to the merger, and should produce cost savings of about $30 million a year.

The deal is expected to close at the end of the second quarter. The companies said that Kelso & Co., which owns 42 percent of Unilab, has agreed to tender all of its shares to Quest under terms of the deal.

|