NEW YORK (CNN/Money) -

A big tumble in IBM kept the Dow Jones industrial average from rising Monday as U.S. stocks staged a late-session comeback despite a profit warning from the No. 1 technology company.

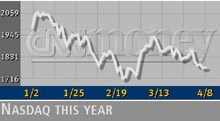

The Dow industrials lost 22.56 points, or 0.2 percent, to 10,249.08 while the Nasdaq recouped all of an earlier 37-point loss, rising 15.75, or 0.9 percent, to 1,785.78. The Standard & Poor's 500 index gained 2.56, or 0.2 percent, to 1,125.29.

David Briggs, head trader at Federated Investors, attributed the comeback to short covering, when investors buy back the shares they had incorrectly bet would fall.

"What we're hearing is that today was predominantly short covering," Briggs said. "I know that there's people that have cash and are stepping in when the market's down."

Briggs said the market's biggest threats in the week ahead will come from the Middle East, where an Iraqi oil suspension Monday sent crude prices higher.

The late turnaround comes amid a mixed period for the markets. Stocks, which rallied late last year, have made no real progress in 2002. The Nasdaq Monday narrowed its year-to-date loss to 8.4 percent while the Dow narrowed its gain to 2.3 percent.

But IBM fell as much as 12.6 percent, taking more than 68 points off the Dow, after saying profits fell short of forecasts last quarter as cautious customers cut spending. Without the negative impact of IBM, the Dow industrials would have logged a gain of about 40 points.

"Clearly, investors were not expecting bad news from IBM," Ben Hock, senior investment strategist at AIM Management Group, told CNNfn's Market Call.

More stocks rose than fell. On the New York Stock Exchange, winners topped losers 9-to-7 as 1 billion shares changed hands. Nasdaq advancers beat decliners 10-to-4 as 1.6 billion shares changed hands.

In other markets, the dollar rose against the euro and slipped versus the yen. Treasury prices fell. Gold prices rose, remaining above the $300 per ounce mark where they've spent much of the year.

Big blues

Blaming a "tough" business environment, IBM (IBM: down $9.84 to $87.41, Research, Estimates), the biggest technology company in terms of sales, said profit in its first quarter will range from 66 to 70 cents a share when the company reports full details April 17. Analysts surveyed by First Call were looking for 85 cents a share.

"We saw a continued slowdown in customer buying decisions in the first quarter," John Royce, IBM's chief financial officer, said in a statement. "Many of our customers chose to reduce or defer capital spending decisions until they see a sustained improvement in their businesses," he said.

In warning, IBM joined Mentor Graphics (MENT: down $0.45 to $19.55, Research, Estimates), PLX Technology (PLXT: down $1.53 to $7.25, Research, Estimates) and Albany International (AIN: down $4.93 to $25.02, Research, Estimates), which all cut guidance Monday. But IBM's losses did not pummel rivals such as Microsoft (MSFT: up $1.35 to $57.22, Research, Estimates) and Dell Computer (DELL: up $0.46 to $26.88, Research, Estimates), which said it expects to meet its profit targets for the current quarter.

Gains continued for 3M (MMM: up $1.70 to $123.63, Research, Estimates), which upped first-quarter earnings forecasts late last week.

"Take IBM out and the market looks pretty much unchanged on the day," Alan Skrainka, chief market strategist at Edward Jones, told CNNfn's Halftime Report.

Kenneth Cole (KCP: up $4.80 to $24.30, Research, Estimates), the footwear and handbag maker, became the biggest gainer on the NYSE after raising first-quarter profit targets. Ameritrade (AMTD: up $0.12 to $6.42, Research, Estimates) also rose. The company said it plans to buy rival Datek Online Holdings for nearly $1.3 billion in stock, creating the No. 3 online brokerage.

The price of light crude rose as high as $27.23 a barrel in New York after Iraq suspended oil exports for 30 days, or until Israeli forces withdraw from Palestinian territory. Oil prices have been rising since Israel, responding to growing Palestinian terrorism, stepped up a broad military sweep of the West Bank.

By increasing costs for consumers and businesses, climbing oil prices could dampen the economic rebound that has helped the Dow industrials this year.

"Rising oil prices are the biggest risk to what is otherwise shaping up as a robust recovery," Merrill Lynch economist Bruce Steinberg told clients Monday.

But oil producers such as Exxon Mobil (XOM: up $0.61 to $43.24, Research, Estimates), one of the Dow's significant gainers, may benefit.

The stock market has gained no ground since the Federal Reserve signaled March 19 it would raise interest rates sometime this year. Central bankers cut short-term borrowing costs 11 times last year and last raised them in May 2000.

Alcoa (AA: down $0.14 to $37.86, Research, Estimates) on Friday reported that its first-quarter profit met forecasts. More companies release results this week for the March quarter, which is expected to mark the fifth straight quarter of declining corporate profits. That hasn't happened since 1970.

General Electric (GE: down $0.24 to $36.86, Research, Estimates), Yahoo! (YHOO: up $0.67 to $18.84, Research, Estimates) and Dow Jones (DJ: up $0.32 to $59.03, Research, Estimates) all are scheduled to trot out numbers by week's end.

Mike Farrell, a quantitative strategist at David L. Babson, said unwarranted bullishness among investors made the market vulnerable to Monday's early declines.

"When people aren't scared, that's generally time to sell," said Farrell, who sees the uncertain profit picture and prospects for war making this a risky time for stock investors.

Hugh Johnson, chief investment strategist at First Albany, has only modest expectations for stocks.

"I don' think we are ready for a major move," Johnson told CNNfn's Street Sweep.

|