NEW YORK (CNN/Money) -

A judge in Delaware has decided to allow Walter Hewlett's legal challenge to Hewlett-Packard's proposed buyout of Compaq to proceed, denying HP's request that it be dismissed.

The suit, filed last month in Delaware Chancery Court, claims that HP executives had used "corporate assets to entice and coerce" Deutsche Asset Management to vote in favor of the proposed deal.

Essentially, Hewlett's suit argues that HP management threatened to lock Deutsche Bank, the money manager's parent corporation, out of future HP investment-banking business if it had voted against it.

It also alleges that HP management made numerous materially false and misleading public statements regarding the potential financial benefits of the proposed deal as well as issues related to the task of integrating the two companies' vast operations.

Hewlett is asking that Deutsche Asset Management's votes, which may have tipped the balance in HP's favor, be invalidated. HP management claimed victory "by a slim but sufficient margin" last month after a shareholder vote on the deal. A certified count of the votes has not yet been returned.

HP asked the court, which specializes in corporate law, to dismiss Hewlett's suit, arguing that even if Hewlett's charges were true, they would not provide a basis for court intervention.

Late Monday, Judge William Chandler III decided not to dismiss the suit, saying that such a decision would only be warranted "where it is clear from its allegations that the plaintiff would not be entitled to relief under any set of facts that could be proven to support the claim."

A trial date has been set for April 23. Those proceedings are expected to last three days.

"It is certainly possible for management to enter into vote-buying arrangements with salutary purposes," Judge Chandler wrote in a 26-page opinion. "However, I conclude that the plaintiffs have stated a cognizable vote-buying claim."

He said that the court has addressed vote-buying allegations on several earlier occasions, and based on those cases it appears there is no "obvious predisposition on the part of the Court one way or another" toward such claims, therefore warranting a closer examination.

As for the claim that HP executives made misleading statements about the integration issues, Judge Chandler said Hewlett's complaint "raises a reasonable inference, accepting its allegations as true, that HP management knowingly misrepresented material facts about integration" in an effort to sway shareholders in favor of the deal.

The decision was a significant victory for Hewlett, who has not been re-nominated for his seat on HP's board. In a brief statement, his camp said it was pleased with the court's decision to deny HP's request for a dismissal and is grateful that it took the matter up so promptly.

Judge Chandler held a hearing on the matter Sunday morning.

For its part, HP said it remains confident that once the facts are heard, it will prevail. The company also said it remains optimistic it will be able to complete the merger on its current schedule.

"HP continues its progress in integration planning and looks forward to the receipt of the certified vote result from the HP shareowner meeting, which is expected within a few weeks," the company said in a statement.

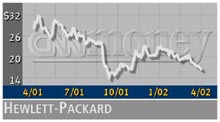

Hewlett is the son of HP (HWP: up $0.13 to $17.12, Research, Estimates) co-founder William Hewlett and the only member of the company's board of directors that is opposed to the merger.

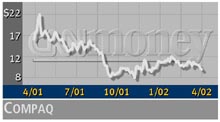

The deal was unopposed by any of Compaq's (CPQ: up $0.03 to $9.59, Research, Estimates) board members, and shareholders approved it in a separate vote last month.

|