NEW YORK (CNN/Money) -

Shares of AT&T Corp. continued to tumble in early trade Thursday as investors continued to mull the significance of the company's plans to consolidate the number of shares outstanding while it prepares to sell its cable television business.

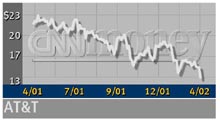

The stock, which has fallen more than 30 percent during the past year, was among the most active on the New York Stock Exchange and among the biggest losers on the Dow Jones industrial average, falling more than 6 percent in early afternoon trading.

In a regulatory filing with the Securities and Exchange Commission Wednesday, AT&T said it would ask its stockholders to approve a 1-for-5 reverse stock split. That would reduce the number of AT&T (T: down $1.21 to $13.21, Research, Estimates) shares outstanding but increase the value of each of the remaining shares.

The split would be made in conjunction with the company's planned sale of its cable television business, called AT&T Broadband, to Comcast (CMCSA: down $2.00 to $28.94, Research, Estimates).

"The reason is to adjust the AT&T common stock price following the restructuring activity, and in particular, after the spinoff of AT&T Broadband," AT&T spokeswoman Eileen Connolly said.

Following the sale of AT&T Broadband, which still requires regulatory approval, the value of AT&T's shares would be brought down below $5, a level that "doesn't meet the profile of our shareholders," Connolly said.

Rob Plaza, an analyst at investment research firm Morningstar, told his clients not to attach too much significance to the announcement of the stock split.

"If the deal to combine cable assets with Comcast closes, AT&T will revert to its original size, having spun off both its cable and wireless properties," Plaza said in a research note Thursday.

"Yet the company will be left with a massive number of shares outstanding, resulting from the creation of its former empire," Plaza added. "Any way you slice AT&T, the important issue is the state of the firm's consumer and business services units."

AT&T also said in its filing Wednesday that its planned tracking stock for its consumer services business likely will be issued by the end of the year, where some expectations had been for an earlier issuance, possibly by the end of this summer.

But AT&T's Connolly stressed that the company, which first announced plans to issue the consumer services tracker in October 2000, always said the timing of its issue would be based on market conditions.

"I don't think it's a real surprise to a lot of people that if we wanted to do this based on market conditions, this may not be the best market to distribute a new stock into, particularly a telecom stock," she said.

Indeed, telecom has been among the sectors hardest hit by the sluggish U.S. economy and telecom stocks have been among the biggest decliners during the past year amid languid growth and dwindling profits.

AT&T did not say when it would present the stock split and tracking stock issues -- as well as several other items in Wednesday's filing -- to shareholders.

Connolly said the company expects to have a shareholder meeting this summer during which the final decisions would be made. She could not provide a more specific timetable.

|