NEW YORK (CNN/Money) -

The New York Yankees have been killing the hopes of other teams' fans for years. Now they're moving on to crushing the hopes of stock holders of Cablevision System Corp. and perhaps other cable operators.

Cablevision (CVC: Research, Estimates), the cable operator which has a bit more than half of the cable households in the New York area in its subscriber base, is in a pitched battle with the team's new regional sports network, the YES Network, on whether Cablevision will carry the station as part of its basic package of stations.

The battle, which has blocked about three million Yankees fans with Cablevision from watching most of the games so far this season, has a lot more implications than whether the nation's richest sports franchise will get even richer. It has the potential to change the balance of power in the long-running battle between cable stations and cable system operators over what fees the networks can win from the operators.

|

|

| Michael Rendino, manager of Stan's Sports Bar directly across from Yankee Stadium, tries to get in touch with DirecTV to sign up for the service so that bar patrons can watch the Yankees. |

That's because YES is successfully urging its fans to switch from Cablevision to DirecTV, the satellite television operator owned by Hughes Electronics (GMH: Research, Estimates) that is offering the new network.

In the past, cable operators were able to say 'no' to even popular networks when they pushed for large per-subscriber fees, because customers couldn't leave for a cable system that offered that desired programming without moving to another community. Cablevision kept Yankee games off its system in 1988 during an earlier dispute.

Neither YES nor DirecTV can give numbers of viewers who have switched. Cablevision says so far defections have been "minimal" although executives won't speculate on whether they will lose more customers if the dispute drags longer into the season. Some projections put Cablevision loss between 3 and 10 percent of customers, or 90,000 to 300,000 subscribers.

"If they lose even 90,000 subscribers, it'd be a breathtaking loss," said YES CEO Leo Hindery, who was once CEO of former cable operator TCI. "When I was on that side of the industry, I never lost a customer willingly. These guys are different. I don't know when it hurts enough for these guys to change their minds."

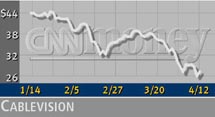

Cablevision's stock has fallen by nearly a third since early March. The problem is that if it agrees to pay the $2 per subscriber YES is demanding, that costs the company about $72 million a year in cash flow. If it continues to say 'no' to YES and loses even 90,000 subscribers, Wall Street's valuation of those lost subscribers would come somewhere in the neighborhood of $300 million, said Jae-Hun Shim, an analyst with Credit Lyonnais. He says this is a lose-lose fight not only for Cablevision but for the industry.

"It's another way that cable fundamentals have been negative," he said. "I would not be surprised if subscriber growth is negative for Cablevision this quarter."

| |

SportsBiz

SportsBiz

| |

| | |

| | |

|

Cablevision has offered to carry YES as a premium service. But Hindery says that would undo the agreements reached with all the other New York-area cable operators who have agreed to carry YES as part of basic service. He points out that Cablevision has two of its own regional sports networks, including the MSG Network that used to carry the Yankees, that are carried on basic in other systems.

YES doesn't want to be a premium service, even if the higher fees taken in that way equaled or topped the $2 per subscriber raised being a basic offering. Being a premium service would limit the number of potential viewers who would watch the games, and that would cut into the network's equally important advertising dollars.

The one sure winner, not surprisingly, is the Yankees.

The team gets a $54 million rights fee from YES, slightly more than Cablevision paid the team last year, so it won't be out any money. Even with the cost of that fee and the loss of potential subscribers and ad revenue due to the Cablevision blackout, Hindery says YES is at about break-even.

| |

Related columns

Related columns

| |

| | |

| | |

|

If or when (probably when) it reaches the three million current Cablevision customers, it will be very profitable. And since 60 percent of YES is owned by YankeesNets, the entity that includes the baseball team and the NBA Nets and NHL Devils, that means a new flow of money to the team.

The potential money available from teams having their own regional sports network is so great that a number of teams are looking at joining the Yankees and starting their own. Even the Minnesota Twins, a team which baseball has slated for possible elimination as soon as next year, is trying to have a mid-season start to a new network.

If the Yankees win this battle, they could actually be helping the other teams in the league, even if it just ends up adding to their already staggering revenue advantage.

|