NEW YORK (CNN/Money) -

The attorney who won a settlement with Merrill Lynch & Co. for a client who lost money following an analyst's advice has filed a similar action seeking $10 million from Salomon Smith Barney and its telecom analyst Jack Grubman for his advocacy of the stock of now-bankrupt Global Crossing Ltd.

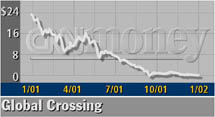

The attorney, Jacob Zamansky, claims that his client, CBS videotape editor George Zicarelli, lost $455,000 and had to file for bankruptcy himself because he was advised by Grubman and his Salomon stock broker to keep buying the stock. Global Crossing filed for bankruptcy protection in January and its shares are now nearly worthless.

"Grubman was issuing these glowing research reports through the end, trying to keep the price of the stock high because of their investment banking relationship with Global Crossing," Zamansky told CNNfn.

Zicarelli told CNNfn his Salomon broker, Daniel Donato, advised him not to be concerned with the declining price of Global Crossing and to buy more shares, citing the "strong buy" recommendation on the stock from Grubman.

Neither Salomon, Grubman nor Donato had any comment on the case, which was filed Thursday as an arbitration claim with the New York Stock Exchange.

Zamansky won a $400,000 settlement last year from brokerage firm Merrill Lynch (ML: Research, Estimates) on behalf of a client who lost money by relying on recommendations from Merrill Internet stock analyst Henry Blodget.

Blodget has since left Merrill, but Zamansky turned over his evidence to New York State Attorney General Eliot Spitzer, who is using it in his case against Merrill Lynch. Spitzer won a court order against Merrill on Monday demanding that it reform its analysts' recommendation. Merrill denies any wrongdoing or conflicts of interest by its analysts.

| |

Related stories

Related stories

| |

| | |

| | |

|

Spitzer said that other brokerage houses would be included in his investigation of analysts' recommendations.

Sources familiar with the investigation told CNNfn earlier this week that Salomon Smith Barney, a unit of Citigroup (C: Research, Estimates), is one of the investment banks to receive subpoenas from Spitzer's office. A source familiar with the situation told CNNfn that Morgan Stanley, Credit Suisse First Boston, Bear Stearns, UBS-PaineWebber, J.P. Morgan Chase, Goldman Sachs and Lazard Freres are also expected to be part of the investigation.

Click here to check other financial stocks

Salmon and Merrill Lynch led the initial public offering of Global Crossing in 1998.

|