NEW YORK (CNN/Money) -

Semiconductor leader Intel Corp. Tuesday logged a modest decline in first-quarter earnings from the same quarter last year on slightly higher revenue.

The company also reaffirmed Wall Street's most recent revenue expectations for the current quarter and said its gross margins, the percentage of sales remaining after subtracting product costs, are likely to improve over the course of the year.

After the close of trading, Intel said it earned 15 cents per share during the quarter. That excludes acquisition-related and other one-time charges and compares with 16 cents per share in the first quarter of 2001.

Accounting for one-time charges, Intel's (INTC: Research, Estimates) net income in the first quarter was $936 million, or 14 cents per share.

The latest earnings results were in line with most analysts' expectations, according to a survey conducted by earnings tracker First Call. 15 cents per share most analysts had expected.

At $6.8 billion, Intel's first-quarter revenue also met Wall Street's expectations and was the $6.7 billion in revenue the company reported in last year's first quarter.

"Revenues turned the corner and were up slightly from last year, driven by significant year-to-year growth in the Intel architecture business," Intel Chief Financial Officer Andy Bryant said, referring to Intel's PC and server microprocessors.

Intel's gross margin, a key measure of profitability, was 51.3 percent in the first quarter, which also was in line with most analysts' expectations.

The company is the world's largest supplier of PC and server microprocessors and derives the majority of its revenue from those product lines. It also makes other kinds of semiconductors, including flash memory and chips used in communications products.

Bryant attributed the strength in Intel's first quarter primarily to the Intel architecture business. He said demand for communications products remains weak.

Moving forward, Bryant said Intel is aiming for revenue in the current quarter ranging between $6.4 billion and $7 billion. The most recent consensus estimate of analysts polled by First Call was for first-quarter revenue of $6.7 billion.

At the same time, he said Intel's gross margin is likely to improve in the second quarter, coming in 53 percent, "plus or minus a couple of points." Intel typically does not provide per-share earnings guidance, choosing instead to set expectations for gross margins.

The mid-point of Intel's targeted revenue range for the second quarter would make it about even with the first quarter, a signal that some industry observers saw as a positive sign.

"The second quarter is a seasonal trough for the PC business, and to indicate that the second quarter may be flat on a relative basis is fairly bullish," said Dan Scovel, an analyst at Needham & Co.

While it still garners roughly 80 percent of the market, Intel has been aggressively pricing its newest Pentium 4 processors in an effort to thwart the advances of Advanced Micro Devices (AMD: Research, Estimates), whose Athlon XP+ and Duron brand processors have been pecking away at Intel's market share.

The latest round of price cuts was Monday, when the company cut the price on its Pentium 4 running at 2.2 gigahertz by 25 percent to $423 each from $562. It also cut prices on its Pentium 4 chips running at 1.9 GHz and 2.0 GHz by 7 percent and 23 percent, respectively.

Helping to offset the impact of the price war on Intel's profits has been its gradual shift to a 0.13-micron manufacturing process from a 0.18 micron process, which refers to the size of the circuits etched into the silicon. Using the 0.13 process yields more chips per silicon wafer and, therefore, improves profitability.

The company also is beginning to use larger, 300-mm silicon wafers, which improves manufacturing efficiency as well.

"The health of our 0.13 micron process technology continues to exceed our expectations with excellent yields at 2 GHz and above," said Paul Otellini, Intel's president and chief operating officer. "We plan to take advantage of this capability to quickly move the sweet spot of the market to 2 GHz beginning this quarter."

In spite of the price aggressiveness, Otellini said the average selling price of its products during the quarter had risen slightly from the prior quarter, attributing the improvement to a richer mix of Pentium 4 chips, as well as growth in sales of chips for mobile computers and servers.

Intel said that unit shipments of its microprocessors were little changed from those in the fourth quarter, including shipments of chips used in Microsoft's new Xbox video game console.

Excluding Xbox chips, unit shipments would have shown a modest decline, Otellini said.

For all of 2002, Intel said it expects it gross margin percentage be 53 percent, "plus or minus a few points," which is higher than its previous expectation of 51 percent, "plus or minus a few points."

Looking beyond the second quarter, Intel is aiming for a gross margin of 53 percent, "plus or minus a few points," for all of 2002, which is higher than its previous expectation for a gross margin of 51 percent, "plus or minus a few points."

In 2001, Intel's gross margin was 49 percent.

"This early progress in profitability is the result of a year-long effort and a validation of Intel's conviction that profits, not revenue, finance growth," Bryant said. "Our financial strategy over the last year has been to preserve profits and protect financial health while proceeding with investments that make Intel more competitive."

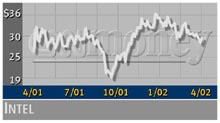

Shares of Intel rose to $31.50 in extended hours trade Tuesday after closing at $29.51 on Nasdaq.

-- Reuters contributed to this report.

|