NEW YORK (CNN/Money) -

American Airlines owner AMR Corp. lost slightly less in the first quarter than Wall Street expected, but said a continued slump in business travel will extend losses into the current period.

The world's largest airline company lost $548 million, or $3.53 a share, excluding special items. That's 2 cents a share less than forecast by analysts surveyed by earning tracker First Call, and narrower than the $4.75 a share it lost on the same basis in the fourth quarter. But it's far wider than the $43 million, or 28 cents a share, it lost in the year-earlier period.

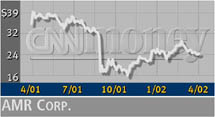

Shares of AMR (AMR: up $0.31 to $24.53, Research, Estimates), which were little changed before its midday earnings report, gained about 1 percent following the release of the report.

The Dallas-based company's revenue dropped 13 percent to $4.1 billion from $4.8 billion a year ago, even though the year-earlier results did not include the former Trans World Airlines, which AMR acquired last spring. Revenue topped First Call's forecast of only $3.6 billion in the period.

Miles flown by paying passengers increased 5.2 percent to 27.8 billion due to the addition of TWA, but the average amount paid per mile flown dropped 15.9 percent to 12.52 cents.

"There is no question that our business overall is improving, and there are a number of particularly encouraging signs with regard to our day-to-day operations," CEO Don Carty said. "But the facts are that business travel, which historically constitutes a major portion of our business, is not rebounding the way leisure travel is, and average fares are down because of heavy discounting."

Click here for a look at airline stocks

The airline did not provide specific loss per share guidance for the second quarter. First Call's consensus estimate is for a loss of $1.06 a share, up from a loss of 68 cents a share a year ago.

|