NEW YORK (CNN/Money) -

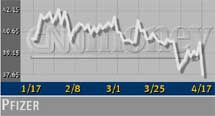

Shares of drugmaker Pfizer Inc. dropped more than 5 percent Wednesday afternoon after the company warned that earnings per share in its second quarter would be lower than Wall Street expectations.

Pfizer (PFE: down $2.10 to $37.80, Research, Estimates) reported first-quarter earnings which were in line with First Call's consensus estimate on sales which rose 11 percent from the year-ago period. But the company said second-quarter earnings would see lower growth than anticipated due to relatively low expenses in the second quarter of 2001.

Pfizer is now looking for second-quarter earnings growth, compared with the second quarter of 2001, to be in the single digits. On average, analysts surveyed by First Call were looking for second-quarter earnings growth of 20 percent to 36 cents per share.

"They met the first-quarter forecast, but it's the second-quarter guidance that bothers me," said Greg Aurand, a portfolio manager for two healthcare funds at Orbitex Management Inc. He said he did not buy Pfizer's explanation for its lowered second-quarter forecast.

"There are some big questions. The revenue numbers look fine, but it sounds like they are spending a lot of money to make money," he said, noting the firm's higher expenses to promote new medicines.

Hank McKinnell, chairman and CEO of Pfizer, told CNNfn that analysts simply didn't realize that the second quarter of 2001 benefited from lower-than-usual expense levels and an adjustment in the tax rate.

"They had been putting the same percentage increase on each quarter, and in an unusually low quarter like last year that didn't' work," McKinnell said. "So we directed them to take down their second-quarter estimates through our guidance."

The company is still confident that it will meet targets of double-digit earnings growth for all of 2002.

"What analysts are coming to understand is that comparisons to last year are particularly difficult in the second quarter," McKinnell said. "And what I am sure they will soon understand is that comparisons are particularly easy in the fourth quarter and that makes our estimate of $1.56 to $1.60 (per share for 2002) fully achievable."

On average, analysts are currently looking for Pfizer to hit the high end of that range, with a First Call consensus estimate of $1.59 per share.

1Q earnings on target but sales miss

Pfizer said in the first quarter, excluding certain items, it earned $2.43 billion, or 39 cents per share, compared with $2.13 billion, or 33 cents per share, in the year-ago period.

Sales rose to $8.41 billion from about $7.6 billion in the first quarter of 2001.

Analysts surveyed by First Call were expecting earnings of 39 cents per share on revenues of $8.8 billion.

Sales of Pfizer's cholesterol drug Lipitor jumped 26 percent from the year-ago period to $1.85 billion. For other big-name drugs, sales of depression treatment Zoloft rose 22 percent while sales of impotence treatment Viagra rose 12 percent from the comparable quarter of 2001.

| |

Related Stories

Related Stories

| |

| | |

| | |

|

Sales of hypertension drug Norvasc rose 8 percent to $931 million from the first quarter of 2001, while revenue of co-promoted drugs, including arthritis treatment Celebrex, edged up 5 percent.

In the pipeline Pfizer said it has five drugs registered for approval in the United States or Europe, all expected to launch this year or soon after. Of those drugs, McKinnell pointed to Spiriva, a once-a-day treatment for smoker's cough, as particularly promising.

McKinnell also said the company is working on a cholesterol treatment, yet to be named, which in combination with Lipitor will take cardiovascular risk from high cholesterol "as close to zero as you can get."

Pfizer forecast double-digit revenue growth and growth in average annual diluted earnings per share of 15 percent or better in 2003 and 2004, excluding the cumulative effect of a change in accounting, some significant items and merger-related costs.

That would reflect a possible slowdown from unmatched earnings growth of 28 percent in 2001 and growth of up to 22 percent slated for this year.

"This slowdown is expected because they are exhausting their cost-savings from the merger. But their earnings growth in 2003 and beyond will still be above most of their peers', thanks to strong drug sales," said Adam Greene of Dresdner Kleinwort Wasserstein.

Orbitex Management's Aurand said Pfizer apparently had to slash its second-quarter forecast in large part because its savings from the $114 billion Warner-Lambert merger are petering out, making it much more reliant on its medicines' sales growth.

"It shows perhaps Pfizer's ability to cut expenses is over now. Flexibility is gone, which creates some problems in meeting forecasts for the year if they can't cut expenses any more," Aurand said.

-- from staff and wire reports

|