NEW YORK (CNN/Money) -

Internet auction site eBay Inc. said Thursday its first-quarter profit more than doubled from the year-ago period, with sales jumping 59 percent.

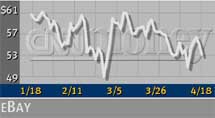

But shares of eBay fell $1.94, nearly 4 percent, to $51.10 in after-hours trading, on apparent disappointment the company did not ramp up guidance for the following quarters and the year.

EBay (EBAY: Research, Estimates) reported net income of $47.6 million, or 17 cents per share, up from $21.1 million, or 8 cents per share, in the first quarter of 2001. Revenue was $245.1 million, consistent with forecasts.

On a pro forma basis, excluding certain items, the company said it earned $50.6 million, or 18 cents per share, 2 cents better than analysts' consensus estimates compiled by First Call.

For the second quarter eBay said it sees sales of $260-265 million, with pro forma earnings of 17 cents per share. Both numbers are right in line with current estimates, but with its first-quarter results the company is now predicting a sequential decline in earnings per share.

For all of 2002, eBay sees sales of $1.05-$1.1 billion, with earnings per share or 73 to 75 cents. According to First Call, analysts are looking for earnings of 75 cents per share and sales of slightly more than $1.1 billion.

"The issue is that eBay has lost some momentum," said Safa Rashtchy, an analyst with U.S. Bancorp Piper Jaffray,

The company said its advertising revenues were about 8 percent of total revenues, down from 13 percent in the fourth quarter. This steep decline at a time when some in the industry thought the ad market was starting to recover raised more concerns about eBay's ability to meet aggressive growth goals.

Even before Thursday's earnings report, the concerns had started to weigh on eBay's share price. The stock, which last year held up better than most in the dot.com sector, has fallen 20 percent so far this year, compared to a 15 percent drop in Yahoo! (YHOO: Research, Estimates) a 7.6 percent drop in the Nasdaq.

"Although the company is still growing at a pretty handsome rate, it hasn't been beating its numbers with substantial upside," said Rashtchy.

Addressing the steep drop in advertising revenues, eBay Chief Executive Meg Whitman told analysts, "We have always said that advertising is just the icing on the cake. It is not the cake."

| |

Related Stories

Related Stories

| |

| | |

| | |

|

However, some analysts said it was an encouraging sign that most of the company's shortfalls came from non-core businesses like advertising.

"The more I delve into the numbers, the better the quarter seemed," said Derek Brown of W.R. Hambrecht. "EBay's core transaction business appears to be stronger than anticipated, while some peripheral elements are underperforming.

Regarding eBay's steadily declining rate of revenue growth, Brown replied, "That seems to be the law of big numbers. Growth has been trending down almost every quarter since the company's inception, so that should not be a surprise."

-- from staff and wire reports

|