NEW YORK (CNN/Money) -

Sun Microsystems Inc. Thursday reported a fiscal third-quarter loss that was slightly less than most expectations on revenue that fell more than 24 percent from the same period a year earlier.

Executives of Sun also said the company is on track to notch a slight rise in revenue and post a small profit during the current quarter. They also said the company will eliminate 1,000 more jobs over the next six-to-nine months.

After the close of trading, Sun said it lost $26 million, or a penny per share, during the quarter ended March 31. That's a penny less than the 2 cents per share loss most analysts had expected, according to a survey conducted by earnings tracker First Call.

At $3.1 billion, Sun's third-quarter revenue fell 24.4 percent from the $4.1 billion it logged in the year-ago period and was slightly below the Street's consensus estimate of $3.2 billion.

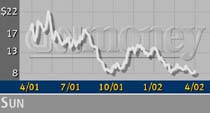

Shares of Sun (SUNW: Research, Estimates) dropped 36 cents to $8.16 in after-hours trade after rising during regular hours.

Moments after Sun's announcement, competitor and legal opponent Microsoft Corp. (MSFT: Research, Estimates) reported weaker-than-expected quarterly results and warned on its earnings and revenue for the current quarter.

Sun is the leading supplier of Unix servers -- large computer systems used for everything from hosting Web sites to executing bank transactions. Its business has been stung sharply by the dot.com collapse, which resulted in the dissolution of scores of dot.com companies, materialized, as well as a substantial slowdown in spending by the telecom service providers that had been beefing up their network infrastructure, largely with Sun's gear.

Additionally, Sun has been wrangling with relentless hardware competition from the likes of IBM on the high end and Dell Computer on the low end. It also competes with Microsoft in certain areas of software and in the emerging market for Web services.

During a teleconference with analysts Thursday evening, Sun executives said they expect revenue to be up "slightly" in the current quarter from the $3.1 billion they just reported. By First Call's count, Wall Street has been expecting an increase of about $400 million in revenue.

They also said the company remains on track to post a small profit in the current quarter, which they have been saying for the past several quarters. First Call's consensus estimate is for a fourth-quarter profit of a penny per share.

The company did not provide specific financial targets, as has been in practice in recent quarters. Sun executives have been somewhat ambiguous in setting financial expectations recently, declining to provide specific targets, citing "limited visibility" and continued uncertainty surrounding corporate IT spending.

One bright spot on Sun's income statment was its gross margin, the percentage of sales remaining after subtracting product costs, which was above 40 percent in the fiscal third-quarter.

"A lot of the bear case about Sun is that they'd never be able to recoup their gross margin," said J.P. Morgan analyst Daniel Kunstler.

"The game was over, it was going to be a commodity product. And here, even in sort of this extremely price-competitive environment, they managed to improve their gross margin,'' Kunstler said.

-- Reuters contributed to this report.

|