NEW YORK (CNN/Money) -

Xerox Corp. said Thursday it has made significant progress in negotiating new terms for a $7 billion revolving loan and expects to complete the refinancing by the end of June.

The statement comes less than a day after the troubled copier maker said in a filing with regulators late Wednesday that while it has taken steps to reduce costs, those efforts might not be enough to help it refinance the loan, meaning it could be declared in default -- a move that could threaten its survival.

But in a brief statement released Thursday morning, Xerox said it has made "significant progress" in restructuring the loans, adding it now expected the deal to be wrapped up "no later than the end of June."

"We expect to complete the negotiations no later than the end of June," Xerox spokeswoman Christa Carone said.

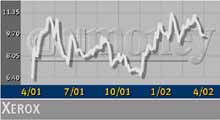

Despite the reassurances, Xerox (XRX: down $0.40 to $9.19, Research, Estimates) stock tumbled 4 percent to $9.19 in Thursday afternoon trading following the statement.

Xerox also noted in Thursday's statement that it has $4.7 billion in cash on hand.

In its filing late Wednesday with the Securities and Exchange Commission, the company said its 57 bank lenders might take legal action against the company if it defaulted on the loans.

"In such event, we would be required to consider the full range of strategic measures available to companies in similar circumstances. These circumstances would raise substantial doubt about our ability to continue as a going concern," Xerox said in the filing.

"That was actually just a worst-case scenario we were required to put in (the filing)," Carone said. "We have no reason to believe that will be the case."

The disclosures about the loan come a week after the SEC filed fraud charges against Xerox and fined it $10 million as part of an agreement to settle charges of alleged illegal accounting.

The troubled copier and office equipment maker has been struggling to turn its business around after losing ground to competitors using more advanced digital printing technology.

Xerox trimmed costs by more than $1.1 billion last year, including expenses related to eliminating 13,600 jobs, bringing its total worldwide workforce to 78,900 by the end of 2001, Carone said.

The company also sold more than $2 billion in assets last year, including a portion of its stake in Fuji Xerox.

|