NEW YORK (CNN/Money) -

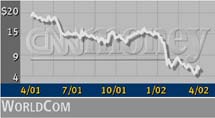

Shares of WorldCom lost almost a third of their value Monday in very heavy trading after a series of analyst downgrades and a lowering of its debt rating following the telecom's after-market revenue and earnings warning Friday.

Shares of WorldCom (WCOM: Research, Estimates) shed $1.97, or 32.9 percent, to $4.01. There were 254.6 million shares traded, making it the third heaviest day of trading in any stock in Nasdaq history. More than one trade out of every seven on the Nasdaq Monday involved a WorldCom share.

Analysts at seven brokerage firms cut their outlook for WorldCom in the wake of the warning. Credit Suisse First Boston and AG Edwards cut their outlook to a "sell" from "hold," while Merrill Lynch & Co. cut to a "sell" on both a short-term and long-term investment basis from a neutral rating in the near term and a "buy" recommendation in the long term.

"Although other companies have reduced guidance in the past several days as well, WorldCom has nearly 100 percent exposure to the long-distance industry, which is experiencing the brunt of the severe difficulty in the telecom industry," AG Edwards analyst Anthony Ferrugia wrote in a note to clients.

Credit rating agency Standard & Poor's lowered WorldCom's long-term corporate credit rating to BBB from BBB+. The lower ratings can increase the company's costs of borrowing money, further hurting its financial results. The new rating put it only one step above the lowest investment grade debt rating of BBB-, and only two steps above so-called "junk bond" status for its debt.

| |

Related stories

Related stories

| |

| | |

| | |

|

S&P also kept WorldCom's long-term corporate credit rating on CreditWatch with negative implications, meaning another downgrade is possible. The short-term corporate credit rating also was lowered to 'A-3' from 'A-2', both of which are middle investment grades. That new, lower rating was removed from CreditWatch, though.

"We continue to anticipate that the enterprise demand prospects in the telecommunications industry will be extremely difficult in 2002 and into the first half of 2003, thereby placing additional pressure on WorldCom's ability to increase cash flow and reduce debt," S&P credit analyst Rosemarie Kalinowski said.

Click here for a look at telecom stocks

WorldCom warned after the market close Friday that it now expects 2002 revenue of $21 billion to $21.5 billion. Analysts surveyed by earnings tracker First Call forecast full-year revenue of $22.2 billion from the unit, which includes its Internet, international data and commercial telephone service.

The Clinton, Miss.-based company also said it expects earnings before interest, taxes, depreciation and amortization, a closely watched measure known as EBITDA, of $7 billion to $7.5 billion.

In February, the company cut its estimates for EBITDA to $8.4 billion to $8.5 billion on revenue of $22.2 billion to $22.6 billion. It said Friday that the new lower guidance was due to lower volume associated with current economic conditions, prompting cuts by its business customers.

The company left guidance for its MCI unit, which handles consumer long-distance service, unchanged. But shares of the tracking stock for MCI (MCIT: Research, Estimates) also fell 77 cents, or 15 percent, to close at $4.23, with 8 million shares traded.

Other telecom stocks also were broadly lower Monday as the warning from WorldCom and a bigger-than-expected loss by wireless phone equipment maker Ericsson dented hopes for a rebound in the embattled sector.

|