NEW YORK (CNN/Money) -

Walt Disney Co. posted a drop in fiscal second-quarter revenue and earnings from operations -- but easily beat Wall Street estimates.

Disney posted net earnings of $259 million, or 13 cents a share, for the quarter ending March 31. Analysts surveyed by First Call had a consensus earnings per share forecast of 10 cents a share. The company earned 25 cents a share excluding special items in the year-earlier period, when one-time charges resulted in a net loss of $449 million, or 21 cents a share.

Revenue dropped to $5.9 billion from $6.0 billion a year earlier, but that also beat First Call's estimate of $5.7 billion. Year-ago revenue would have been $6.2 billion if the recently acquired ABC Family channel had been part of the company.

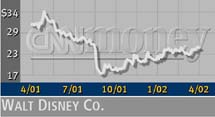

Shares of Disney (DIS: Research, Estimates), a component of the Dow Jones industrial average, were up about 1 percent to $25.22 in after-hours trading. A late rally lifted shares 48 cents to close regular hours trading at $25.00 before the report.

During a conference call with analysts, company executives said that the company is on track to meet earnings guidance that it gave in January, which entailed a continued decline in operating income in current third fiscal quarter compared with a year earlier, but then an improvement in earnings in the fourth quarter.

"The message of the second quarter, as with the first, is that Disney continues on track," said a statement from CEO Michael Eisner. "We continue to see encouraging signs in our parks and resorts unit and we are highly focused on addressing the challenges at the ABC network."

Revenue from the company's media networks, its largest division, fell 9 percent to $2.2 billion, and operating profit from the unit fell 39 percent to $309 million. The company was hit by both a softer advertising market that affected most of its networks and a steep slide in earnings at its broadcast ABC network that took the network from No. 2 to No. 3 among U.S. networks, and from No. 2 to No. 4 among key viewers 18-to-49 years old.

| |

Related stories

Related stories

| |

| | |

| | |

|

The network ended up in a closely watched but unsuccessful wooing of "CBS Late Show" host David Letterman in March, a move that would have bumped ABC's well respected "Nightline" news program. Perhaps in a further effort to heal the rift with the staff of "Nightline," Eisner claimed Thursday that the financial performance of news and late night programming is not a problem for the network.

"There's only really one cloud," Eisner told CNNfn's Money & Markets Thursday. "Our sports assets, our cable channels, daytime, news, late-night are doing fine. Our primetime schedule has had a performance problem. When you put that together with a softness in advertising, it makes things worse."

Click here for a look at media and entertainment stocks

Eisner said the company believes that a new head of programing an a slate of 26 new shows for the fall season should help, but he conceded the turnaround will be a long process.

"It's the only part of the company that needs triage, but it's getting it," he said.

Parks and resorts, its second largest division, saw revenue fall 8 percent to $1.5 billion and operating income fall 15 percent to $280 million. But that was an improvement from the 51 percent decline in operating income in the first quarter, immediately in the wake of the Sept. 11 terrorist attacks. The company said it continued to see lower attendance and occupancy rates at hotels compared to the year-earlier period, although results were helped by increased attendance and the absence of pre-opening costs at the Disneyland Resort.

Company executives told analysts that the numbers of international visitors to U.S. resorts are still lagging behind those of a year ago. They said in looking at future bookings that British visitors seem to be coming back while Latin American and German visitors have yet to show improvement.

"The trend seems to be going in the right direction," Eisner told CNNfn. "We're feeling better, the economy seems to be moving in the right direction."

Studio entertainment saw revenue edge up 2 percent, although operating income fell by 84 percent due to a difference in when marketing and promotion costs were booked. Consumer products saw revenue up 1 percent while operating income fell 5 percent.

|