NEW YORK (CNN/Money) -

A rash of warnings from VeriSign, JDS Uniphase and General Mills pummeled U.S. stocks Friday as the market suffered its fifth losing week in six.

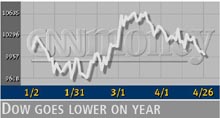

The Dow Jones industrial average wiped out its gain for the year, but it remains better off than the Nasdaq composite index, which tumbled to a sixth-month low.

A weaker-than-expected consumer confidence reading from the University of Michigan hurt, pushing back hopes for the economic rebound that investors have been waiting for.

The Dow industrials lost 124.34 points, or 1.2 percent, to 9,910.72, closing below 10,000 for the first time since Feb. 22 and ending down 1 percent on the year.

The Nasdaq fell 49.81 points, or 2.9 percent, to 1,663.89, for its worst finish since Oct. 18. The Standard & Poor's 500 index retreated 15.16 points, or 1.4 percent, to 1,076.32, widening its 2002 loss to 6.2 percent.

The University of Michigan said its survey of consumer sentiment fell below forecasts in April, a month when stocks slipped, oil prices rose, and Middle East tension accelerated.

Friday caps a busy two-week stretch for companies reporting March-quarter profits, which probably declined for a fifth straight quarter for their longest slump since 1970.

Mike Farrell, a quantitative strategist at David L. Babson, links some of the losses to investor distrust born of Enron's collapse and fueled by widening investigations into conflicts of interest on Wall Street.

"It's mostly the financial chicanery that's going on," Farrell said. "People are saying 'What kind of trust can we put in this market?'"

Investors, he said, are scaling back expectations for a strong rebound in economic and profit growth. "We are looking at sentiment data that's starting to weaken," said Farrell, referring to the Michigan numbers. "I don't think we are going to get this virtuous cycle."

The Michigan data followed the government's report that the U.S. economy grew at an annual rate of 5.8 percent in the first quarter, well above forecasts and the biggest increase since the last three months of 1999. But economists expect the growth rate to slow in the current quarter.

"That type of growth is not sustainable, and we're headed to a more moderate pace this year," William Sullivan, economist at Morgan Stanley, told CNNfn's Street Sweep.

More stocks fell than rose. On the New York Stock Exchange, decliners topped advancers 3-to-2 as 1.3 billion shares traded. Nasdaq losers beat winners 2-to-1 as 1.8 billion shares changed hands.

In other markets, the dollar continued to slip versus the yen and euro. Treasury securities rose for a third session. Gold prices jumped as high as $312.50 an ounce.

More warnings

Nasdaq's second-most actively traded stock, VeriSign (VRSN: down $8.35 to $9.89, Research, Estimates), a maker of Internet security software, warned that current-quarter financial results will fall short. At least five brokerage firms downgraded VeriSign, whose shares tumbled nearly 46 percent.

JDS Uniphase (JDSU: down $0.50 to $4.53, Research, Estimates), which makes fiber-optic equipment, warned that it will lose more money in the current quarter than expected. And General Mills (GIS: down $2.37 to $42.93, Research, Estimates), the maker of cereals Wheaties, Total and Cheerios, said profits over the next two years will miss forecasts.

The three companies join WorldCom (WCOM: down $0.26 to $3.27, Research, Estimates) and Ericsson (ERICY: down $0.11 to $2.43, Research, Estimates), whose shortfalls sank stocks earlier this week.

"I think investors were too optimistic about an earnings recovery in the first quarter," Bernadette Murphy, technical analyst at Kimelman & Baird, told CNNfn's Halftime Report.

The Nasdaq, down 7.4 percent on the week, widened its 2002 loss to 14.7 percent. The Dow fell 3.4 percent over the past five sessions while the S&P shed 4.3 percent of its value.

The GDP numbers fueled convictions that the economy has come a long way just months after the Sept. 11 terrorist attacks. But the pace of the corporate profit rebound has frustrated investors who have not had a winning year since 1999.

Rory Robertson, chief strategist at Macquarie Holdings, said the GDP gains were fueled by temporary factors that will likely not show up in the current quarter.

"Everybody has agreed that Q1 (the first quarter) was strong, and guess what? It was," said Robertson, who noted that a warm winter boosted the housing market while a boom in mortgage refinancings put more money in consumers' pockets.

"It's looking more and more like Q2 will be softer," Robertson said.

One of the Dow's biggest losers, Walt Disney (DIS: down $0.90 to $24.10, Research, Estimates), said fiscal second-quarter profit beat Wall Street estimates, though it fell from year-ago levels. The media company said it expects profit to pick up by its fiscal fourth quarter, ending in October.

Macquarie's Robertson, who contrary to most economists says the Federal Reserve might not hike interest rates this year, blames some of the market's troubles on its past success.

"The stock market continues to struggle with the fact that it tripled during the '90s," he said. "The inclination to buy the pullback isn't what it was."

Questions about the credibility of stock research from brokerage firms haven't helped. The Securities and Exchange Commission Thursday joined forces with New York's attorney general in investigating whether Wall Street analysts touted stocks to win lucrative investment banking business for their bosses.

In a related development, Merrill Lynch (MER: up $0.88 to $43.38, Research, Estimates) CEO David Komansky apologized Friday for recent e-mails from the brokerage house's analysts that may have damaged the integrity of the firm's research.

|