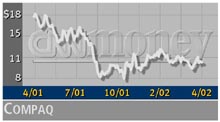

NEW YORK (CNN/Money) - A Delaware business judge has dismissed Walter Hewlett's legal challenge to Hewlett-Packard Co.'s proposed buyout of Compaq Computer Corp., clearing the way for completion of the hotly contested $18 billion merger.

Not long after Tuesday's ruling, Hewlett, the son of one of HP's co-founders, issued a statement saying he would not appeal the decision, issued after a three-day trial last week in Delaware Chancery Court, which specializes in corporate law.

The developments all but assure completion of the deal, which would be the biggest ever in the computer industry. The companies have been aiming to integrate their businesses starting next week.

In his opinion, Judge William Chandler III said that Hewlett's lawyers did not prove that HP executives had made false and misleading public statements regarding the potential financial benefits of the proposed deal or the task of integrating the two companies' vast operations. He also ruled that they had not improperly used corporate assets to "entice and coerce" certain shareholders to vote in favor of the deal.

"Based on all of the testimony and exhibits ... I conclude that plaintiffs have failed to prove that HP disseminated materially false information about its integration efforts or about the financial data provided to its shareholders," Judge Chandler wrote.

"In addition, I concluded that plaintiffs have failed to prove that HP management improperly enticed or coerced Deutsche Bank into voting in favor of the merger," the judge added.

Hewlett was the only member of HP's (HWP: Research, Estimates) board of directors opposed to the deal, and he has spent millions over the past six months in his effort to block it. In his statement issued late Tuesday, he said he would also drop efforts to challenge the vote count, and added that he would work to support the merger.

HP claims that it won the vote by a "slim but sufficient margin" after shareholders voted at a special meeting last month. A certified count has not yet been returned, but a preliminary tally released two weeks ago found that HP won the shareholder vote by a margin of 45 million shares, more than the 17 million to 24 million believed to have been cast by Deutsche Asset Management, the investor that Hewlett alleged was coerced by HP.

Hewlett, who has not been renominated for his seat on HP's board, filed the lawsuit in late March. In his complaint, he argued that HP management had misled investors about the potential financial impact of the deal by not sharing all of the information they used in evaluating the deal.

He also claimed that HP management effectively had bought the votes of Deutsche Asset Management by putting pressure on its investment banking parent company, Deutsche Bank, with the promise of future investment banking business should they vote in favor of the deal and the threat of being locked out of future business should they vote against it.

Deutsche Asset Management has defended its decision to vote in favor of the deal, saying it was based on presentations made by both sides and was made solely in the interest of its clients.

The Securities and Exchange Commission as well as the U.S. Attorney's Office for the Southern District of New York also are investigating the HP shareholders' vote.

The trial in Delaware featured 10 hours of testimony from HP's top two executives, CEO Carly Fiorina and Chief Financial Officer Robert Wayman.

Hewlett's side presented evidence including a voice mail that was leaked to the press in which Fiorina suggested to Wayman that they need to "do something extraordinary" for Deutsche Bank. The plaintiffs also pointed to a conference call with Deutsche money managers about an hour before the shareholder vote began during which Fiorina said their decision was "of great importance to our ongoing relationship."

Hewlett attorneys also said HP's proxy solicitor had noted on a planning chart that HP had a "carrot of future business" to use in lobbying Deutsche Bank.

Fiorina and Wayman each testified that they asked Deutsche money managers to support the deal on its merits and did not resort to coercive tactics.

In his opinion, Judge Chandler said there was "nothing in those exchanges that indicates a threat from management that future business would be withheld by HP from Deutsche Bank," saying that Hewlett's argument was supported solely by "circumstantial evidence."

Judge Chandler said he did not believe that Fiorina's voice mail "evidences an intent to employ improper means to persuade Deutsche Bank to vote in favor of the merger."

At the same time, the judge described as "troubling" the fact that some of the members of Deutsche Bank's investment banking business set up a conference call with Deutsche Asset Management and HP management to discuss the merger.

"This fact raises clear questions about the integrity of the internal ethical wall that purportedly separates Deutsche Bank's asset management division from its commercial division," Judge Chandler wrote.

In support of the claim that HP executives had misled investors, Hewlett's team presented internal HP projections that showed the deal would fall short of its publicly disclosed targets.

The HP executives testified that the weak projections were drawn up by HP and Compaq (CPQ: Research, Estimates) managers who intentionally set low targets they knew they could beat, a process know as sandbagging, which happens frequently in business.

Chandler said he found HP's explanation "compelling" and "corroborated by evidence in the record."

"HP is gratified by the ruling, and we look forward to the opportunity to move on," an HP spokeswoman said.

An official vote count is expected any day.

|