NEW YORK (CNN/Money) -

U.S. stocks fell Friday, closing out a tumultuous week, as signs of a slowdown in the economic recovery unnerved investors following the release of reports showing weakness in the labor market and services sector.

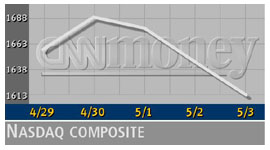

The Nasdaq composite index -- which started the session at a nearly seven-month low -- dropped 31.79 to 1,613.03; for the week, the index lost 3 percent.

The Dow Jones industrial average, up the prior three sessions, lost 85.24 to 10,006.63; it had been down almost 150 points earlier in the session. However, for the week, the index closed on the plus side, up 1 percent after gaining 240 points in the first two days of trade.

The Standard & Poor's 500 index fell 11.13 to 1,073.43; for the week, the index lost 0.3 percent.

After a muddled week, "the positive you can look to is that the Dow held above 10,000 and the Nasdaq held above 1,600," Mike Murphy, head of equity trading at Wachovia Securities told CNNfn's Street Sweep. "Next week, people will be looking to the Fed meeting and the notes from the meeting early in the week and then the PPI (Producer Price Index) Friday."

A struggling economy continues to take its toll on the labor market. The unemployment rate rose to 6 percent in April from 5.7 percent in March, the government said. Economists were expecting a rise to 5.8 percent. Employers added only 43,000 jobs last month, when economists expected 60,000. The March payroll number was revised to a loss of 21,000 from the initially reported gain of 58,000.

"Any bad news can throw us, and the jobs report was perceived as bad news, seen as a sign that the recovery is fragile, but that's not necessarily true," said Jack Ablin, chief investment strategist at Harris Trust. "In the last two recessions, a pickup in employment only happened a year after the recession had ended. So just because unemployment is higher doesn't mean we're not on track for a recovery."

Business activity in the services sector also slowed a bit more than expected, with the Institute of Supply Management's survey declining to 55.3 in April from 57.3 the prior month. Economists were expecting a drop, but only to 57. A reading above 50 still implies expansion in the sector.

"We're still in a negative trend. Long-term interest rates are too high, earnings estimates are still too high," said Robert Bloom, president of LF Capital. "We've had seven out of eight down weeks, so we saw a little bounce in the beginning of this week. But the downward pressure hasn't eased."

Weakness in stocks gave Treasurys strength, with the 10-year note yield falling to 5.06 percent. The dollar rose against the euro but continued to slide versus the yen.

Light crude oil futures rose 41 cents to $26.65 a barrel. Weakness in stocks benefited defensive sectors, with gold prices rising to $311.20 an ounce.

WorldCom, Oracle under pressure

Business software maker Oracle (ORCL: down $0.12 to $8.43, Research, Estimates) was subject to a number of negative currents. Goldman Sachs cut its earnings per share estimates for the second and third quarters while SG Cowen cut fourth-quarter and fiscal 2002 earnings per share estimates. Both firms cited a slowdown in Internet technology spending and business momentum.

In addition, California Gov. Gray Davis accepted the resignation of one state official and suspended another as a result of a controversial deal involving Oracle software that was supposed to save the state $16 million, but may end up costing it $41 million in wasted spending.

Weakness in semiconductors sent the Philadelphia Semiconductor index, or Soxx, to four-month lows, with selling in names such as Intel (INTC: down $1.31 to $26.56, Research, Estimates) and Applied Materials (AMAT: down $0.70 to $22.17, Research, Estimates).

Shares of phone service provider WorldCom (WCOM: down $0.24 to $1.79, Research, Estimates) continued to sell on concerns about the company's long-term prospects and overall weakness in the telecom sector.

"The problem for the Nasdaq remains in telecoms," said LF Capital's Bloom. "Telecom layoffs were far worse than any other sector, with the industry cutting 38,000 jobs last month."

While the jobs report was a disappointment to most on Wall Street, analysts said continued weakness in the labor market could mean the Federal Reserve will keep rates steady when it holds its policy meeting next Tuesday.

"The potential is that there could have been a surprise that could have influenced the Fed next Tuesday, and clearly that hasn't happened," said Douglas Altabef, managing director at Matrix Asset Advisors. "But employment is a lagging indicator. So the report is not a reflection of where the economy is going, but where it's been."

In international markets, European stocks rose by the close, while Asian exchanges closed mostly higher, although Japan was closed for a holiday.

Market breadth was mixed. On the New York Stock Exchange, winners beat losers by almost 8-to-7 as 1.28 billion shares changed hands. On the Nasdaq, decliners beat advancers by 6-to-5 as 1.96 billion shares traded.

|