NEW YORK (CNN/Money) -

U.S. stocks slipped at midday Thursday as investors doubting the staying power of the previous session's big rally unloaded stocks such as Cisco Systems, Wal-Mart Stores and General Electric.

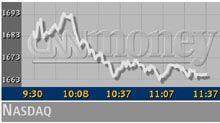

At 1:03 p.m. ET, the Nasdaq slipped 27.48 points to 1,668.81, a day after posting its eighth-best percentage gain on record. The Dow Jones industrial average lost 61.79 to 10,080.04 while the Standard & Poor's 500 dipped 8.72 to 1,080.13.

The major indexes were well off their lows of the day, which occurred shortly after noon ET,

after the Federal Reserve announced that traces of anthrax were found in about 20 pieces of mail tested at an offsite facility. But the Fed also downplayed the finding, saying the initial tests are often unreliable and that none of the tainted mail matches the type the FBI has labeled as potentially suspicious. At its nadir, the Dow was down 125 points and the Nasdaq was nearly 43 points lower.

Drew Cupps, portfolio manager at Cupps Capital Management, with about $50 million in assets, said he was impressed that the market didn't tumble further after Wednesday's big gain.

"It's a big move to digest," said Cupps, who predicts that investors looking for more clues about the strength of corporate spending may get few definitive answers in the weeks ahead. "We are not in an earnings period."

One NYSE trader also some saw light in the generally dismal session. "If our selloffs tend to be on much lighter volume than the gains, then that's nothing to worry about," Linda Jay, trader at LaBranche & Co, told CNNfn's Market Call.

More stocks fell than rose on volume that was significantly lighter than Wednesday's. On the New York Stock Exchange, declining shares topped advancing ones 7-to-5 as 651 million shares traded. Nasdaq losers beat winners 5-to-3 as 1.04 billion shares changed hands.

Overseas, Asia's and Europe's stock markets were mixed. Treasury securities held steady following Wednesday's big selloff. The dollar slipped against the euro and yen.

Cisco slips

Signs that companies are starting to spend money on new equipment faded Thursday as Cisco Systems (CSCO: down $0.58 to $15.69, Research, Estimates) gave back some of Wednesday's 24-percent surge.

The communication equipment maker's better-than-expected profit came before a reassuring forecast from General Electric (GE: down $1.23 to $31.62, Research, Estimates).

The Dow's biggest loser, Wal-Mart Stores (WMT: down $1.50 to $54.89, Research, Estimates), the world's biggest company by revenue, said sales at stores open at least a year rose 3.3 percent in April -- half the gain of the year-earlier month.

Wednesday's winners became Thursday's losers. IBM (IBM: down $1.57 to $80.88, Research, Estimates) and Microsoft (MSFT: down $1.82 to $53.15, Research, Estimates) both slipped.

The latest economic data showed that the number of Americans filing for first-time jobless claimsfell by 11,000 to 411,000 last week for the third straight drop in weekly claims.

The Dow industrials' 305-point surge Wednesday erased its loss for the year. But numerous one-day rallies over the last two years have proved short lived as investors, worried about more losses, cash in on gains.

I

|