NEW YORK (CNN/Money) -

The Securities and Exchange Commission plans to scrutinize Dynegy Inc. for two electricity trades the company made in the fall that gave the impression of high volumes but actually cancelled each other out, a newspaper reported Thursday.

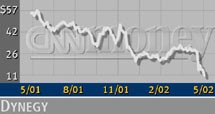

Dynegy (DYN: down $0.14 to $11.01, Research, Estimates) shares were down almost 1 percent in afternoon trading.

The trades, which occurred at the same time for the same price and traded in opposite directions, were meant to boost the company's image, sources close to the situation told the Wall Street Journal.

Dynegy performed the two electricity trades, which the company valued at $1.7 billion, with a unit of CMS Energy Corp. (CMS: down $0.16 to $20.02, Research, Estimates), the Journal said.

Dynegy denied it profited from the trades and said they were done to test its online trading platform, DynegyDirect.

During a conference call Wednesday, the company said "no one else saw the transactions. It was zero to revenue and zero to volume. We did not benefit financially...The reason was to fulfill a customer request and test the parameters of our online platform. It was to stress-test DynegyDirect."

CMS Energy also disputed the report, saying it did not record revenue or income from the trades. The SEC would not comment on whether it was investigating the trades.

Word of the probe comes just one day after the SEC said it would seek an investigation into Dynegy's natural gas deal "Project Alpha," which decreased the company's tax payments but boosted cash flow last year.

Experts said these transactions that give the illusion of volume, dubbed "round-trip" trades, happen often within the energy trading business.

In addition, Dynegy's Rough offshore natural gas storage facility was hit by a fishing vessel Wednesday. The majority of personnel on the platform were evacuated.

|