NEW YORK (CNN/Money) -

Sears, Roebuck & Co. returned to its roots Monday, buying catalog retailer Lands' End Inc. for $1.9 billion in cash, nearly a decade after it abandoned the century-old catalog business that made it famous.

Lands' End (LE: Research, Estimates) shares jumped nearly 21 percent after the announcement of the deal, in which Sears agreed to pay $62 for each Lands' End share, a 21.5 percent premium over Friday's closing price.

"We wanted to be in retail, and now we've got 870 stores, so we're really in retail," Lands' End CEO David Dyer told CNNfn's Street Sweep program.

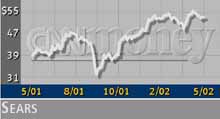

Sears (S: Research, Estimates) shares also rose. Most analysts agreed that the deal, which is expected to be completed in June, would help the No. 2 U.S. retailer's recent efforts to overhaul its image and display its "softer" side -- ironically, by turning to a company that specializes in catalogue sales, a marketing tool Sears pioneered in the 19th century.

"We're acquiring a great brand, [and] introducing it into our stores will attract new shoppers...who will connect with our apparel departments better than they would have in the past," Sears CEO Alan Lacy told Street Sweep.

| |

|

Sears, which shuttered its legendary "Big Book" catalog in 1993, agreed Monday to purchase catalog, Internet retailer Lands' End for $1.9 billion.

|

|

Both executives joined analysts in downplaying concerns that the lower-brow merchandise at Sears -- including tools and dishwashers -- would clash with the high-end offerings of Lands' End, which has its roots in the exclusive sailing culture.

"The presence of Lands' End apparel in Sears' full-line stores is expected to give Sears the strong brand-name recognition in apparel that they currently have in hardlines [such as] Diehard, Craftsman [and] Kenmore," said Daniel Barry, an analyst at Merrill Lynch, which handled Sears' latest public securities sale.

"The higher-end Lands' End offerings should appeal to Sears' hardline customer, who often has not shopped the softline departments," Daniel added.

Both companies are headquartered in the Midwest, with Sears based in Chicago and Lands' End in Dodgeville, Wis. And Lands' End CEO Dyer pointed out that one of his company's early influences was former Sears executive Tom Filline, who ran Sears' mail-order business for several years before advising Lands' End founder Gary Comer.

"We share a lot of common character and culture," Dyer said.

Short-term profit setback

Maybe. While Comer claims to have dreamed up the idea for Lands' End while "bumming" in Davos, Switzerland, in the 1960s, Sears has a considerably more rugged history. In the early years of the 20th Century, rural Americans often bothered to keep only two books in their frontier homes -- their Holy Bible and their Sears catalog.

But the so-called "Big Book" catalog, which gave customers in remote locations the ability to buy practically anything they wanted -- including houses, at one point -- eventually outlived its profitability and was discontinued in 1993.

Lands' End, on the other hand, excelled, unlike other catalog ventures, including J. Crew -- which opened its own underperforming stores -- and Fingerhut, whose delinquent credit problems dragged down Federated Department Stores (FD: up $0.21 to $41.08, Research, Estimates), which bought, and later sold, the operation.

There will be short-term costs associated with blending the two companies together, a process not expected to end until the fall of 2003 -- though Lands' End products are expected to be in most Sears stores by this fall. When the integration is complete, Lands' End products will take up 18 to 20 percent of Sears' apparel selling space, Lacy said.

The merger could weigh on Sears' earnings in 2002 and 2003, although Sears reiterated its expectations of 17 percent earnings growth in 2002. Analysts polled by earnings tracker First Call expect 2002 earnings of $5.03 a share, about a 16 percent increase from $4.22 earned a year ago. Sears said the merger would begin to significantly help earnings in 2004.

Sears executives stressed that the deal was not made to cut costs, though some administrative and sourcing jobs will likely be cut.

It was unclear how investors would react to the prospect of Lands' End, whose full-year earnings per share grew 96 percent from 2000 to 2001 and whose stock is trading at 23 times the current year's earnings, coupling with Sears, whose earnings per share grew just 0.24 percent in the same period and whose stock currently trades at 10 times earnings.

Dan Kapusta, co-manager of Bank One Investment Advisors' Mid-Cap Growth fund -- which owns Lands' End stock -- said Lands' End's 23-times-earnings multiple is about average compared with similar chains such as Talbots Inc. (TLB: up $0.71 to $37.71, Research, Estimates), Limited Inc. (LTD: up $0.21 to $20.61, Research, Estimates) and TJX Co. (TJX: down $0.61 to $20.69, Research, Estimates) Sears' multiple is at the low end of the range of other department stores, which trade anywhere from 8 to 13 times earnings, he said.

"I'm really happy as a Lands' End shareholder, but...it's going to be a question of execution," Kapusta said. "Does it dilute the brand when you put it into the mass market? That'll be a test for the consumers."

Kapusta also worries about whether Lands' End truly has the national acceptance necessary to boost Sears' apparel sales: "What is the real reach for the customer in New York and Los Angeles? What do they think of this product?"

Lands' End CEO Dyer responded to that concern by pointing out that its biggest sales markets were California and New York, respectively.

Hard times for department stores

Sears and other department stores have been struggling with declining sales in the past few years, as the economy made consumers more cost-conscious -- and discount chains such as Wal-Mart Stores Inc. (WMT: Research, Estimates) and Target Corp. (TGT: Research, Estimates) have been happy to oblige, offering fashionable items at much lower prices.

That has left executives at companies such as Federated Department Stores and May Department Stores (MAY: down $0.30 to $34.72, Research, Estimates) scrambling for ways to lure customers back without always resorting to steep margin-eroding sales.

Sears dropped its cosmetics business -- a staple for most traditional department stores -- last year, and CEO Lacy has made no secret of his desire to upgrade Sears' apparel business, even as the company also focused more on its offerings in appliances and hardware.

| |

Related stories

Related stories

| |

| | |

| | |

|

"They are now getting into the apparel business in a way they have not known before -- in a way that establishes Sears Roebuck as a major operation in apparel," said Kurt Barnard, president of Barnard's Retail Consulting Group.

Lands' End CEO Dyer would not discuss whether or not his company had considered hitching its wagon to another retailer, saying such questions would be answered in the tender offer it expects to file "in the next week or so."

Lands' End will keep its headquarters in Wisconsin and continue its separate catalog and Internet operations. Though it said experimental stores in Minneapolis and elsewhere were successful, there were no plans to launch separate Lands' End stores.

Customers will be able to return items ordered through the Lands' End catalog or Web site to Sears stores.

|