NEW YORK (CNN/Money) -

Novellus Systems Tuesday raised its earnings target for the second quarter and said orders for its chip-making equipment have been stronger than expected.

During a mid-quarter financial update with analysts, Novellus (NVLS: Research, Estimates) CEO Richard Hill said the company is aiming for a second-quarter profit of 8 cents per share. The most recent consensus estimate of analysts polled by First Call was for a profit of 7 cents per share.

At the same time, he said net bookings for the second quarter are likely to come in at $275 million, where the company previously had forecast bookings of $250 million.

Chip-equipment orders sometimes are used as a barometer for the semiconductor industry because they can indicate future demand.

Earlier this month, Applied Materials (AMAT: Research, Estimates), the No. 1 chip-equipment maker, reported stronger-than-expected orders for its most recent quarter and raised the forecast for future orders.

But there has been some debate among industry analysts with respect to the sustainability of the improvements, and chip-equipment makers' stocks have been somewhat volatile recently.

The more pessimistic industry observers point out that the recent spike in chip-equipment orders could be just a near-term blip as chipmakers replenish their inventories, which had become bloated over the past 18 months.

Goldman Sachs, for example, cut its rating on the chip-equipment sector Friday to "market weight" from "market overweight," noting that the stocks it covers have outperformed the Nasdaq by nearly 30 percent since February.

The firm said it feels more comfortable on the sidelines until the outlook for the sector improves or until chip equipment stocks fall 20-to-25 percent.

More optimistic analysts say the recent trend in order improvements is a sign that the industry has turned the corner and is on its way to a long-awaited recovery.

Hill said Novellus is seeing an upturn that has been fueled largely by consumer demand. At the same time, he said the sustainability of the upturn is dependent upon renewed corporate confidence and increased corporate spending.

"There are some early indications that that's beginning to happen," Hill said. "There also are some significant government expenditures for [information technology] that are starting to be anticipated in the market"

"All of those types of factors will bode well for our industry as a whole," Hill added. "But they've yet to materialize fully so that we can say, 'Yup, we're off to the races.' "

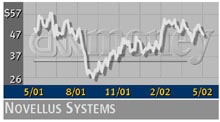

Shares of Novellus rose 1.1 percent on Nasdaq ahead of Tuesday's call, which took place after the closing bell. They fell to $45.69 in extended hours trade.

|