NEW YORK (CNN/Money) -

Semiconductor stocks led the technology sector lower Wednesday as industry observers weighed in with mixed reviews of Novellus Systems' latest financial update.

News of more job cuts at Nortel Networks, a leading telecom equipment supplier, as well as a flurry of unsettling news about other networking companies, also contributed to the negative sentiment in the tech sector.

The Nasdaq composite index, which is weighted heavily with technology names, moved steadily lower throughout the session, ending it down 27.78 points at 1624.39, a 1.7 percent decline on the day.

Volume on Nasdaq was very light, with roughly 1.4 billion shares changing hands, making for one of the slowest trading days of the year.

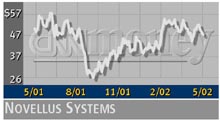

Chip stocks were among the biggest losers, with Novellus Systems (NVLS: down $3.27 to $43.40, Research, Estimates), a top supplier of chip making equipment, standing out from the crowd, falling 7 percent.

In a mid-quarter conference call with analysts after the close of trading Tuesday, Novellus raised its earnings target for the current quarter by a penny and said orders for its chip-making equipment have been stronger than expected.

Chip-equipment orders sometimes are used as a barometer for the semiconductor industry because they can indicate future demand.

Executives of Novellus also provided a somewhat optimistic outlook, saying they see an upturn fueled largely by consumer demand. They would not, however, provide any financial guidance beyond the current quarter, and they cautioned that the sustainability of the upturn is dependent upon renewed corporate confidence and increased corporate spending.

Earlier this month, Applied Materials (AMAT: down $1.02 to $23.10, Research, Estimates), the No. 1 chip-equipment maker, reported similarly strong orders for its most recent quarter and raised the forecast for future orders as well.

But there has been no consensus on Wall Street about the sustainability of the recent improvements.

Pessimistic industry observers suggest the recent spike in chip-equipment orders could be just a short-term blip as chipmakers replenish their inventories, which had become bloated over the past 18 months. More optimistic analysts say the recent trend in order improvements is a sign that the industry has turned the corner and is on its way to a long-awaited recovery.

Novellus' comments did little to bring those two schools of thought any closer together.

Goldman Sachs, which last week cut its rating on the chip-equipment segment to "market weight" from "market overweight," reiterated its cautious stance on Wednesday, advising its clients to stick to the sidelines until a meaningful pickup in information technology spending becomes evident.

At the same time, Credit Suisse First Boston reiterated its "hold" rating on Novellus' shares, telling its clients that the more upbeat outlook management provided on Tuesday's call already is reflected in the stock price.

Meanwhile, Merrill Lynch reiterated its "strong buy" rating on Novellus, advising its clients to take advantage of current price weakness. The firm said Novellus stands to benefit from an industry-wide shift to semiconductors that are built using copper wires, as opposed to the aluminum wires that currently are the standard.

UBS Warburg also boosted Novellus on Wednesday, suggesting that Wall Street has underestimated the company's potential for profit improvements and revenue growth, calling it "our best pick for continued share price appreciation into the remainder of the capital spending upturn."

Shares of Teradyne (TER: up $0.30 to $27.83, Research, Estimates), the No. 1 maker of systems for testing semiconductors during the manufacturing process, managed to escape the selloff, ending the session 1.1 percent higher.

That rise came after J.P. Morgan upgraded its rating on Teradyne's shares to "buy" from "long-term buy," and set a price target of $36. The firm called Teradyne "the market share and technology leader in semiconductor test systems with growing market opportunity," and said it expects it to outperform its peers in the net to intermediate term.

Most chipmakers stocks ended lower. Among those finishing deep in the minus column were: Intel (INTC: down $1.08 to $27.27, Research, Estimates); Altera (ALTR: down $0.72 to $18.16, Research, Estimates); Lattice Semiconductor (LSCC: down $0.39 to $10.79, Research, Estimates); Texas Instruments (TXN: down $1.17 to $28.72, Research, Estimates); and Xilinx (XLNX: down $1.43 to $34.83, Research, Estimates).

The Philadelphia Stock Exchange's semiconductor index, which lists 16 chip and chip-equipment makers, ended Wednesday's session 16.55 points lower at 480.1, a 3.3 percent decline on the day.

More bad news from the telecom industry pressured the stocks of telecom and networking equipment makers.

Nortel Networks (NT: down $0.17 to $2.35, Research, Estimates) shares were among the biggest movers on the New York Stock Exchange, ending the session 6.8 percent lower.

That decline came after the company, a leading supplier of fiber-optic telecommunications and networking equipment, cut its outlook for second-quarter revenue and announced plans for 3,500 more job cuts.

Nortel and its competitors have suffered from a dramatic downturn over the past year in spending on new equipment, especially by telecom service providers. But Nortel's shares have been further pressured, dropped to their lowest level in nearly a decade on May 13 after the company filed $2.5 billion in new debt and equity securities to raise cash, and investors worried their holdings would be diluted.

Meanwhile, shares of JDS Uniphase (JDSU: down $0.22 to $3.77, Research, Estimates), a leading supplier of the components used by Nortel and others to build fiber-optic networking equipment, ended Wednesday's session 5.5 percent lower.

Credit Suisse First Boston on Wednesday downgraded its rating on JDS Uniphase's shares to "buy" from "strong buy," and trimmed its price target to $7 from $10. The firm cited continued weakness in capital spending by telecom carriers as well as concerns about the liquidity of some of the company's customers such as Qwest Communications (Q: down $0.14 to $5.06, Research, Estimates), WorldCom (WCOM: down $0.04 to $1.77, Research, Estimates) and BroadWing (BRW: down $0.32 to $3.29, Research, Estimates), all of which recently have had their credit ratings cut.

Long-distance leader AT&T (T: down $0.40 to $12.01, Research, Estimates) was the latest service provider to have its credit ratings cut. Moody's Investors Service on Wednesday cut its corporate credit rating on AT&T to "Baa2" from "A3," putting it two levels above "junk" status.

Shares of Cisco Systems (CSCO: down $0.73 to $15.65, Research, Estimates), the top supplier of the equipment used to guide traffic over the Internet, fell 4.5 percent.

Late Tuesday, Cisco filed its comprehensive financial report with the Securities and Exchange Commission, some elements of which raised concerns among some company watchers.

Merrill Lynch on Wednesday raised a "yellow flag" on Cisco's allowance for doubtful accounts, which the firm said has risen to its highest levels ever both in absolute dollars and as a percentage of gross receivables.

The growing allowance could have ramifications on earnings quality in the future, as a significant change in that number could affect operating margins, or if used would result in previously booked revenues being questioned, Merrill said.

At the same time, Dresdner Kleinwort Wasserstein downgraded its rating on Cisco's shares to "sell" from "hold," citing questions about Cisco's gross profit margins, stock option compensation and off-balance sheet commitments.

Other networking-equipment makers ending Wednesday's session deep in the minus column included: Juniper Networks (JNPR: down $0.44 to $9.87, Research, Estimates); Redback Networks (RBAK: down $0.21 to $2.21, Research, Estimates); and Sycamore Networks (SCMR: down $0.05 to $3.64, Research, Estimates).

Lucent Technologies (LU: up $0.01 to $4.86, Research, Estimates) and Extreme Networks (EXTR: up $0.23 to $11.62, Research, Estimates) were among the few networking stocks escaping Wednesday's selling pressure.

The American Stock Exchange's networking index ended the day 3.82 points lower at 205.67, a 1.8 percent decline.

|