NEW YORK (CNN/Money) -

Microsoft Corp. and federal regulators are in talks to settle a long-running inquiry into whether the company delayed recognizing some revenues in order to keep from disappointing Wall Street analysts in weaker reporting periods, although the settlement will likely not involve a fine, according to a person familiar with the situation.

Microsoft first disclosed the investigation in a June 1999 regulatory filing, saying that the Securities and Exchange Commission was scrutinizing the company's reported results from 1995 through 1998.

Xerox paid a $10 million fine to settle charges that it overstated its revenue by $2 billion between 1997 and 2000. Microsoft is not accused of inflating apparent results, but of artificially reducing them, which may be why the SEC might go along with a settlement without a fine, the source said.

The Securities and Exchange Commission will instead settle the matter by suing the Redmond, Wash.-based company in civil court for failing to keep accurate books and records, the result of which will likely be little more than a promise from Microsoft to toe the line in the future, according to a report in Thursday's edition of the Wall Street Journal.

"We take our financial reporting responsibilities very seriously, and we work hard to comply with every aspect of the company's reporting obligations," a Microsoft spokesman reportedly said. "Microsoft has cooperated fully with the SEC, but because this is not a public inquiry, it's not appropriate to comment further."

The allegation against Microsoft is that it improperly put some of its revenue aside for a rainy day, holding it in reserve so it could be used to boost results during cyclical slumps in software sales, according to the Journal report.

But regulators, who made their investigation public in 1999, were unsure whether or not Microsoft had actually ever used the reserve revenue to boost results during slow periods, the report said, and that uncertainty could lead to a light penalty for the company.

| |

Related links

Related links

| |

| | |

| | |

|

The report also speculated that the SEC might have shied away from aggressive pursuit of the issue for fear of becoming engaged with Microsoft's battle-hardened force of attorneys.

The company has been defending itself against federal and state government suits for years, mainly over allegations that it used its market dominance to bully computer manufacturers and others to favor its products.

Microsoft and the U.S. Department of Justice settled the issues between them in October, but nine states have challenged the settlement as inadequate.

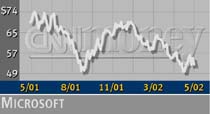

Shares of Microsoft (MSFT: Research, Estimates) fell 27 cents Wednesday to close at $52.05, well off their 52-week high of $76.15.

|