NEW YORK (CNN/Money) -

U.S. stocks closed out a volatile week on a low note Friday, with markets unable to sustain a midday reversal amid profit warnings from Intel and Biogen, worries about corporate governance and the threat of international tensions still looming.

The Dow had flirted with gains in afternoon trade briefly before retreating, while the Nasdaq also sharply cut losses before falling back down.

The Nasdaq composite fell 19.40 to 1,535.48; it was down as much as 59 points earlier in the session. For the week, the composite fell more than 80.25 points, or 5 percent. The composite currently stands at is lowest level since early October of last year.

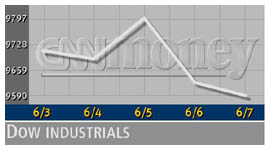

The Dow Jones industrial average lost 34.97 to 9,589.67, rebounding from being down as much as 152 points. For the week, the average lost more than 335 points, or 3.5 percent. The average is at its lowest level since mid-November of last year. The Standard & Poor's 500 index gave back 1.62 to close at 1.027.53; for the week, the index lost almost 40 points. The S&P 500 is at its lowest level since late September of last year.

Despite a grueling day, "there is a feeling that we saw a near-term bottom today [Friday]," Mike Murphy, head of equity trading at Wachovia Securities, told CNNfn's Street Sweep. "Monday will be important to see if we can bounce off that bottom."

Next week brings economic reports on wholesale goods, retail sales, industrial production, business inventories and consumer sentiment, as well as an earnings report from graphic-design software maker Adobe Systems (ADBE: Research, Estimates).

Intel's (INTC: down $5.00 to $22.00, Research, Estimates) mid-quarter update late Thursday was the key to the opening selloff. The chipmaker warned it expects revenue of between $6.2 billion and $6.5 billion in the current quarter, below its previous range of $6.4 billion to $7 billion, due to weak European sales. Intel also cut its gross profit margin forecast to roughly 49 percent, from the 53 percent previously expected.

Market sentiment worsened when biotech developer Biogen (BGEN: down $5.54 to $42.16, Research, Estimates) said earnings for its second quarter and for 2002 will miss estimates.

Troubled conglomerate Tyco International (TYC: down $4.50 to $10.10, Research, Estimates) continued to decline. The company said it is launching an internal investigation into the use of its funds by former CEO Dennis Kozlowski. Meanwhile, regulators said that they are widening their investigation of Kozlowski to find out whether Tyco bought homes and artwork for several executives without disclosing it.

But there were signs of improvement in the U.S. economy. The rate of unemployment declined to 5.8 percent in May from 6.0 percent in the previous month. Economists surveyed by Briefing.com were expecting a rise to 6.1 percent. Separately, employers added 41,000 new jobs last month, less than expected but the most since February 2001. The additions follow a revised 6,000 gain the previous month.

"The economy is holding up. We had good employment numbers this morning," said Jon Burnham, portfolio manager at Burnham Securities. "In the short term, I wouldn't be surprised to see a rally early next week."

Chips still struggle, but heavyweights come back

Weakness continued for chips and telecoms, but other big-name techs managed to close off of lows. RF Micro Devices (RFMD: down $5.12 to $10.12, Research, Estimates), a maker of chips used in mobile phones, hurt the wireless sector after it said that second-quarter results will miss current expectations due to customers pushing back shipping dates of orders.

J.P. Morgan cut its rating on Intel, Advanced Micro Devices (AMD: down $0.80 to $9.81, Research, Estimates) and nVidia (NVDA: down $0.31 to $32.30, Research, Estimates), while Robertson Stephens downgraded AMD.

But tech heavyweights Oracle (ORCL: up $0.21 to $8.36, Research, Estimates) and Cisco (CSCO: up $0.27 to $15.73, Research, Estimates) reversed earlier losses.

The threat of global terrorism has been a factor hanging over markets. In a televised address Thursday, President Bush called on Congress to add a new cabinet-level homeland defense agency. Separately, the Senate has passed a $31.5 billion counter-terrorism bill.

Treasury prices fell, pushing the yield on the ten-year note up to 5.06 percent.

In global trade, European stock markets were broadly lower, while Asian markets fell on tech weakness. The dollar was weaker versus the euro and a little stronger versus the yen.

Light crude oil futures fell 9 cents to $24.75. The price of gold declined 40 cents to $325.40 an ounce.

Market breadth was mixed in active trading. On the New York Stock Exchange, winners topped losers 8-to-7 as 1.8 billion shares changed hands. On the Nasdaq, decliners beat advancers by 9-to-8 as 2.09 billion shares traded.

-- Kim Khan contributed to this report.

|