NEW YORK (CNN/Money) -

Merck & Co. Inc. said Tuesday it will delay its application for federal regulatory approval of its painkiller Arcoxia until the second half of 2003.

The No. 1 U.S. drugmaker withdrew its previous application for Arcoxia on March 15. Since then, it has talked to regulators at the U.S. Food and Drug Administration, who asked for additional data on the cardiovascular safety of the drug.

Merck said it will conduct new studies on the drug and seek approval for its use against several forms of pain, including arthritis and gout.

Arcoxia already has been approved for use in Mexico, Brazil, Peru and the United Kingdom. Merck said it expects to get approval of the drug in other European countries in the next few months.

Lehman Brothers analyst Anthony Butler said he didn't think Merck could re-file until the fourth quarter of 2003 and pointed out that the delay could push actual U.S. marketing of Arcoxia far into the future.

"After enrollment, a 12-month review would result in a fourth-quarter 2004 launch," Butler said. "This timeline must be considered best-case; thus, we cannot rule out a first-quarter 2005 launch."

Whitehouse Station, N.J.-based Merck also reaffirmed that its global sales of Arcoxia and related drug Vioxx will be between $2.8 billion and $3.1 billion in 2002.

Merck also said it expects its 2002 earnings per share to match its 2001 EPS of $3.14 and expects "double-digit" growth in 2003. Analysts surveyed by earnings tracker First Call expect the company to earn $3.13 in 2002 and $3.43 in 2003.

| |

Related links

Related links

| |

| | |

| | |

|

Merck also said it is comfortable with the range of analyst estimates for its second quarter EPS, as compiled by First Call, of 75 to 78 cents.

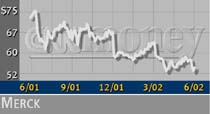

Merck (MRK: down $1.78 to $52.52, Research, Estimates) shares fell more than 3 percent in early trading Tuesday. The stock was punished last week when the company revealed plans to change the labeling of its blockbuster cholesterol drug Zocor.

|