NEW YORK (CNN/Money) -

Samuel Waksal, the former CEO of ImClone Systems Inc. who hobnobbed with Mick Jagger and Martha Stewart, was charged Wednesday with tipping off people to sell their ImClone stock right before regulators rejected the company's application for a new cancer drug.

Waksal, who was arrested by FBI agents at his Manhattan home early Wednesday, was charged with securities fraud, conspiracy and perjury, according to the U.S Attorney's office for the Southern District of New York.

The Securities and Exchange Commission filed a separate civil action against Waksal, saying he warned family members who held shares of ImClone that Erbitux, a would-be blockbuster cancer drug, would not win approval from the Food and Drug Administration. The SEC said two unidentified family members sold about $10 million of ImClone stock during the next two days.

The SEC also said that Waksal tried for two days to sell nearly 80,000 ImClone shares for about $5 million, but two different brokers would not execute the orders.

Waksal, who was released on $10 million bail, did not speak to reporters as he left court. But his lawyers issued a statement calling the evidence in the case "entirely circumstantial."

"The government misread that evidence, and it over-reacted in deciding to make today's arrest," the lawyers said in a brief statement. "Dr. Waksal looks forward to the opportunity to defend these charges."

ImClone issued a statement saying it was aware of Waksal's arrest and that it intended to cooperate fully with investigations by the SEC and Congress.

If convicted, Waksal faces up to five years in prison on the conspiracy and perjury charges and up to 10 years on the securities fraud counts. He also could be fined $1 million or more.

In addition, the SEC said it wants Waksal to pay "the several million dollars" in losses his family members allegedly avoided, as well as unspecified penalties and interest. It also wants to bar Waksal from acting as an officer or director of a public company.

Several people associated with Waksal and ImClone -- including Waksal's friend, home-decorating guru Martha Stewart -- have been scrutinized by federal investigators for selling ImClone stock in late December 2001, just days before the FDA formally refused to approve Erbitux.

Stewart issued a press release late Wednesday saying she did not speak to Waksal regarding the sale and did not have any nonpublic information regarding ImClone when she sold 3,928 shares at $58 each. That comes to $227,824.

"In placing my trade I had no improper information," Stewart said. "My transaction was entirely lawful."

SEC spokesman Barry Rashkover would not say whether the regulatory agency planned to bring charges against anyone else, but did not rule that possibility out, saying its investigation was continuing.

Sources have told CNNfn that ImClone was warned of the FDA's rejection two days before it happened.

Industry analysts have said ImClone executives had concerns about the effectiveness of Erbitux months before the FDA's rejection. Sam Waksal and his brother Harlan, who became CEO after Sam resigned in May, sold about 2.3 million shares of ImClone between Oct. 29 and Dec. 6 of last year, grossing about $161 million.

Some of those shares went to drugmaker Bristol-Myers Squibb Co. (BMY: down $0.56 to $25.44, Research, Estimates), which took a $1 billion equity stake in ImClone as part of a $2 billion marketing agreement.

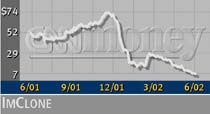

ImClone (IMCL: up $0.28 to $7.83, Research, Estimates) shares have plunged from about $74 in early December 2001 to little more than $7 early Wednesday. They got a brief boost during a surprisingly congenial shareholder meeting Tuesday, in which Harlan Waksal admitted the company's credibility had been damaged by its handling of the Erbitux approval.

He did not address insider trading, but ImClone executives have denied improper trading.

Waksal brothers to appear before Congress

ImClone's stock soared in 2001 as investors eagerly awaited the arrival of Erbitux, a drug intended to fight colorectal and other forms of cancer. The FDA at first put the drug on a fast track for approval, and Sam Waksal said he hoped to sell it in the United States by 2002.

In the months since the FDA rejected the drug, several investors have sued Waksal, accusing him of misleading them about the likelihood of its approval and costing them millions of dollars.

Federal regulators also are investigating the ImClone stock trades and Erbitux approval process, and a congressional subcommittee is scheduled to hear testimony from Harlan Waksal, FDA regulators and others Thursday.

The New York judge involved in the Sam Waksal case is extending the travel restrictions to allow Waksal to testify before Congress Wednesday, Justice Department spokesman Brian Sierra said.

But a spokesman for Sam Waksal could not confirm that Waksal will travel Wednesday. Still, he was expected to assert his Fifth Amendment right against self-incrimination.

Ken Johnson, a spokesman for Billy Tauzin, R-La., Chairman of the House Energy and Commerce Committee, a subcommittee of which subpoenaed Waksal, said it appeared Waksal had made false statements to investigators. "His problems are mounting," Johnson said.

Bristol-Myers, which sought to remove both Waksal brothers, to alter its marketing deal and to gain total control of the FDA approval process in the weeks following the FDA rejection, was unavailable for comment. The company eventually consented to allow the Waksals to stay in place.

When Sam Waksal resigned in May, he said the controversies were distracting him from ImClone's business. Investors already had accused him of being distracted by his jet-setting lifestyle -- he was known for hosting star-studded parties and for dating both Martha Stewart and, later, her daughter Alexis.

The U.S. Attorney's indictment of Waksal said he had more than $80 million in debt as of Dec. 26, 2001, more than $65 million of which was margin loans secured by his ImClone shares. At the time, he was required to pay more than $800,000 a month to service that debt.

|