NEW YORK (CNN/Money) -

Lehman Brothers posted a sixth straight drop in quarterly profit Tuesday as the investment banking business endures another year of slowing stock sales and falling corporate acquisitions.

The firm, the first of four major brokers to report results this week, earned $296 million, or $1.08 a diluted share, in the period ended May 31. That's down from $430 million, or $1.38 a diluted share, a year earlier. Analysts surveyed by earnings tracker First Call had a consensus forecast of $1.05 a share.

Lehman's profits have been falling since the February quarter of 2001, when the business of stock underwriting began to slow. Fees from advising on mergers and acquisitions have also dried up. In response, investment banks have been shedding thousands of jobs to save money.

Chief Financial Officer David Goldfarb signaled the weakness may persist.

"In terms of the outlook for the remainder of 2002, we continue to remain cautious," Goldfarb told investors on a conference call, according to Reuters.

Lehman said net revenue, which excludes interest expense, fell 18 percent to $1.66 billion in the latest quarter, from $2.02 billion a year earlier, but it edged the First Call forecast of $1.63 billion.

"Lehman's key issue is whether the company can show a real up-turn in revenues and profits," Judah S. Kraushaar, who covers the company for Merrill Lynch, told clients Tuesday. "We suspect investors may have to await the 4Q for better results in this regard."

Commission revenue actually increased 13 percent to $332 million, but revenue from merger and acquisition advising fell. Still, Lehman gained market share in many investment banking product categories as well as posting near-record revenue from bonds.

Encouraged by low interest rates, companies have been selling bonds before borrowing costs go higher.

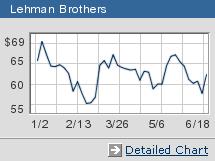

Lehman (LEH: Research, Estimates) shares are down about 20 percent from their 52-week high. In addition to weak market conditions, brokerage stocks have been hurt by a concern over greater regulatory action following the $100 million settlement between New York State and Merrill Lynch & Co. over its analysts' recommendations.

"Lehman's key issue is whether the company can show a real up-turn in revenues and profits," Judah S. Kraushaar, who covers the company for Merrill Lynch, told clients Tuesday. "We suspect investors may have to await the 4Q for better results in this regard."

Merrill's Kraushaar calls Morgan Stanley (MWD: Research, Estimates) and Goldman Sachs (GS: Research, Estimates) more attractive based in valuation.

|