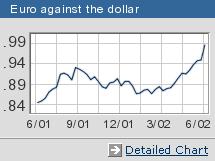

NEW YORK (CNN/Money) - The dollar continued its downward slide Friday as the euro neared parity with the U.S. currency, but the greenback bounced back slightly after two central banks stepped in to weaken the yen.

The New York Federal Reserve and European Central Bank sold yen for dollars and euros on behalf of the Bank of Japan to weaken the Japanese currency, a currency trader told CNNfn.

It was less clear why the euro backed off its highs of the session.

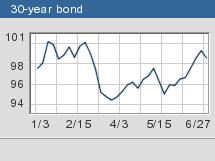

Meanwhile, long-term U.S. Treasury bonds recovered some of their early losses as another round of accounting woes weighed on equity prices, bolstering safe-haven government debt.

News that office equipment maker Xerox Corp. expects to restate revenue further battered confidence in the ability of the United States to keep drawing in enough overseas capital to finance its huge current account deficit. The euro, already up sharply this week after telecom provider WorldCom admitted to improper accounting, bought 99.13 U.S. cents late Friday, up from 98.84 cents Thursday.

The dollar also fell to nine-month lows against the yen, purchasing ¥119.54, up from ¥119.39 Thursday.

"The dollar's come under more selling pressure and this is liable to continue. The news about Xerox just doesn't help," said Neil Parker, market strategist at RBS Financial Markets.

Soros blames Bush for falling dollar

Billionaire investor George Soros blamed President Bush and his team for the fall in the U.S. dollar late Thursday and declared: "The international financial system is coming apart at the seams."

"I think we're in fairly serious trouble. I do think we're in a crisis situation," the Hungarian-born hedge fund king-turned-philanthropist said in a speech to the London Business School Thursday evening.

"We have the Latin American crisis and we have the declining U.S. dollar, which means that the motor of the global economy is basically switched off," Soros said.

"There is a lack of confidence. That's what I call the 'Bush factor' in the economy," he added.

Long-term bonds rise

Two-year Treasury notes remained unchanged at 100-25/32, yielding 2.81 percent, and the five-year note added 2/32 to 101-14/32, yielding 4.04 percent.

Ten-year notes rose 1/32 to 100-14/32, yielding 4.81 percent, down from 4.82 percent at Thursday's close, and the 30-year bond shed 1/32 to 97-30/32 even, yielding 5.51 percent, unchanged from yesterday's close.

Significant profit-taking in Treasurys can occur only once the stock market has rallied for three or four days, said Dave Winter, a trader at Zions First National Bank Capital Markets. "WorldCom is still page one, accounting issues are still page one, and people feel like they need a safe haven."

News that Congress approved a $450 billion increase in the country's credit limit Thursday cleared the way for the government to proceed with planned debt auctions.

The market will be closed next Thursday for the Fourth of July U.S. Independence Day holiday and the Bond Market Association has recommended early closing Wednesday and Friday, the days bracketing the holiday.

But Winter said the market probably would be able to absorb next week's two-year auction with relative ease.

"We won't have much time to bid on these things, but near the holiday some heightened fear of terrorism will be coming into the market, so the safe-haven bid will not go away."

Friday reports file in

Though Treasurys are expected to remain under the influence of the equity market, traders were keeping any eye on the economic data being announced Friday.

The Commerce Department said personal spending fell 0.1 percent in May to $7.33 trillion after rising 0.6 percent in April, while personal income rose 0.3 percent to $8.97 trillion after rising 0.2 percent in April. Economists surveyed by Briefing.com expected spending to be flat and income to rise 0.3 percent.

Also falling, but somewhat less than expected, was the Chicago Purchasing Managers index of manufacturing activity, down to 58.2 in June from 60.8 in May. Economists expected, on average, a reading of 58.0.

The University of Michigan revised its reading of consumer sentiment in June upward to 92.4 from a previous estimate of 90.8, according to a Reuters report. Economists surveyed by Briefing.com expected a reading of 90.8. The sentiment index was 96.9 in May.

-- from staff and wire reports

|