NEW YORK (CNN/Money) -

It's a big day for the business world in Washington as senators grill telecom and banking executives regarding two Wall Street scandals and President Bush signs a corporate fraud measure into law.

The bill includes the creation of a new oversight board to monitor the accounting industry, new and tougher penalties for corporate fraud, and more money for the Securities and Exchange Commission.

|

|

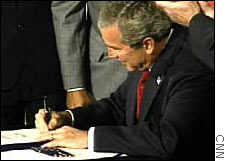

| President Bush signs the corporate reform bill into law at the White House. |

"Today I sign the most far-reaching reforms of American business practices since the time of Franklin Delano Roosevelt," Bush said during the signing ceremony at the White House, attended by lawmakers and members of the corporate fraud task force created after the recent accounting scandals.

The law, shepherded through the House and Senate by Paul Sarbanes, D-Md., and Mike Oxley, R-Ohio, was prompted by a spate of corporate accounting irregularities at companies such as Enron and WorldCom, which sought to look more profitable.

The bill also quadruples the maximum prison term for executives who commit corporate fraud to 20 years from five years.

Bush said the law sends a message on several levels. To corporate executives the president said the law says, "No boardroom in America is above or beyond the law."

Click here to read the newly signed bill

Full coverage ...

Enron's bankers

What role, if any, did some of Wall Street's biggest banks, particularly Merrill Lynch, play in the collapse of Enron? The Senate Permanent Subcommittee on Investigations is trying to find out. Tuesday's hearing are focusing on recent reports of investment banks giving the energy trader favored treatment in exchange for business.

Reports that Merrill possibly forced out an analyst who had given Enron a "neutral" rating in order to land more business from the energy concern could be another blow to the nation's largest securities firm, which earlier this year agreed to a $100 million settlement as well as changes in its research department following conflict-of-interest charges brought by N.Y. Attorney General Eliot Spitzer.

Full coverage ...

Telecom tempest

Another group of senators is looking at what the implosion of the telecom sector means for consumers. Executives from WorldCom, Qwest Communications (Q: down $0.20 to $1.29, Research, Estimates) and Global Crossing are appearing before the Senate Commerce, Science and Transportation Committee. Recent plans by WorldCom to shut down its wireless business will probably come under fire, as will recent accounting revelations by the other outfits.

Federal Communications Commission Chairman Michael Powell told the panel that "this market is not collapsing. It is not going to fail over time. Communications services remain vital to consumers around the globe."

Powell added that the sector is struggling under $2 trillion in debt and that profits in U.S. long-distance services are down 68 percent.

Full coverage ...

Cross my heart

Meanwhile, the Securities and Exchange Commission has launched its Web site listing which CEOs have officially signed off on their companies' numbers. As of Tuesday morning, only nine of 947 companies had their paperwork in. The other 938 have until Aug. 14.

Last month the SEC ordered the top executives of 947 large companies to sign a statement that their companies' financial statements are accurate "to the best of my knowledge" and to fill out forms explaining why it was not the case if they couldn't sign the statement.

Full coverage ...

|