NEW YORK (CNN/Money) - Applied Materials Tuesday logged a fiscal third-quarter profit that topped most analysts' expectations while new orders came in below the company's forecast.

Executives of the world's largest supplier of the equipment used to manufacture semiconductors also said they expect orders in the current quarter to decline as much as 15 percent from the third quarter's level, but said profits should improve.

After the close of trading, Applied Materials said it earned $115 million, or 7 cents per share, for the quarter, matching the profit it reported during the same period last year and exceeding Wall Street's consensus estimate of 5 cents per share.

At $1.46 billion, Applied Materials' third-quarter revenue also exceeded expectations but was 7 percent below the $1.58 billion it reported a year ago.

Meanwhile, new orders in the third quarter totaled $1.78 billion, Applied Materials said. That's an improvement of 47 percent over last year's third quarter but below the company's prior forecasts.

Applied Materials executives previously had said they expected new orders in the third quarter to range between $1.86 billion and $1.94 billion.

"Uncertainty in the economy is dampening the ramp in our industry and caused our orders to be lower than expected," James Morgan, Applied Materials' chairman and CEO, said on a conference call Tuesday evening.

In the face of an uncertain economy, he said chipmakers are takings a "more cautious stance" when it comes to committing to capital equipment spending.

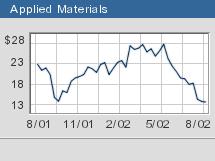

Shares of Applied Materials (AMAT: Research, Estimates) fell 45 cents to $13.01 in extended-hours trade Tuesday after slipping 12 cents to $13.46 on Nasdaq ahead of the earnings news.

Because it is the No. 1 maker of chip-making gear, Applied Materials is considered a bellwether, and many industry observers look at its results as a leading indicator for the overall chip industry.

Industry analysts tend to focus on the company's ordering patterns to gauge the broader conditions in the semiconductor industry. Strengthening orders typically are a leading indicator of improving end demand for semiconductors, while weakening orders suggest slack demand.

After a sharp rise in Applied Materials' orders in recent quarters, sentiment on Wall Street had turned somewhat negative, as many company watchers began attributing the sudden spike in orders to chipmakers gearing up for the second half of the year, during which demand for their products typically is stronger.

Looking ahead, Joseph Bronson, Applied Materials' chief financial officer, said the company is expecting fourth quarter orders to decline between 5 percent and 15 percent from the third quarter's level, a fairly wide range that is in line with most expectations.

Banc of America Securities on Tuesday told its clients it was expects Applied Materials to forecast a decline in bookings in the current quarter ranging between 5 percent and 10 percent. Other company watchers have been expecting a bookings decline nearer 20 percent.

Bronson said Applied Materials' is aiming for fourth-quarter revenue that is equal to or slightly above the $1.46 billion the company just logged for the third quarter. At the same time, he said earnings are likely to be higher than the 7 cents per share it just reported for the third quarter, attributing the anticipated rise to strict cost controls.

At last count, analysts polled by First Call generally had been expecting Applied Materials fourth-quarter revenue to come in at $1.48 billion and earnings to be 9 cents per share.

Bronson and Morgan also said they will certify the company's financial statements, as is now required by the Securities and Exchange Commission, by Sept. 11, when it files its comprehensive quarterly financial report with the agency.

Following a series of corporate accounting scandals, the SEC established a rule requiring the senior executives of companies that had 2001 revenue of at least $1.2 billion to take an oath certifying that their financial statements are correct.

|