NEW YORK (CNN/Money) -

A war between the United States and Iraq most likely would have only a short-term impact on the U.S. economy -- though the downside risks are awful.

President Bush and members of his administration have called for the removal of Saddam Hussein from power in Iraq and have been openly debating about how to accomplish this goal.

Though Iraq this week offered to allow United Nations inspectors to look for weapons of mass destruction, Vice President Dick Cheney has recently said further inspections won't be enough to nullify the threat Hussein poses to the Middle East and that "the risks of inaction are far greater than the risk of action."

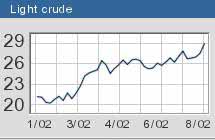

Some of the plans leaked to the press in recent months have involved a full-scale invasion of Iraq by U.S. forces, leading some observers to worry that such an attack would raise the price of oil, hurting the U.S. and global economies.

"In the long term, one assumes that, if we go to war, we'll win, and things will settle down afterwards in terms of the oil markets," said Bill Cheney, chief economist at John Hancock Financial Services. "But in the short term, that's a huge danger to the economy, both in terms of the direct impact of having to spend more scarce money on oil and the indirect impact on consumer confidence."

Iraq's invasion of Kuwait in 1990 and subsequent spanking by U.S.-led forces in 1991 helped fuel a recession in 1990-91 by forcing oil prices higher. Higher oil prices act as an extra tax on companies and consumers, raising the cost of transporting goods, heating buildings and more.

Iraq is the fifth-biggest source of U.S. oil imports, according to Energy Department data for May, the latest data available, and it's a member of the Organization of the Petroleum Exporting Countries (OPEC), which accounts for 40 percent of the world's oil output and sits on more than three-quarters of the world's proven oil reserves.

| |

Related stories

Related stories

| |

| | |

| | |

|

"Every day the sun rises, the world consumes 75 million barrels of oil. If there's any disruption in that supply, the price will be seriously rising," Youssef Ibrahim, a senior fellow with the Council on Foreign Relations, told CNNfn's Market Call program. "A war with Iraq is almost certain to cause a disruption of some kind."

Struggling U.S. airlines, many of which have filed for, or are on the brink of bankruptcy due to a recession that began in March 2001 and a dramatic drop-off in air travel following the Sept. 11 terrorist attacks, are probably most unhappy about the prospect of a war in Iraq.

Airplanes, tanks and other materiel use up an awful lot of "middle distillates," or diesel and jet fuel, when fighting a war -- up to 750,000 barrels per day, according to Lawrence Goldstein, an oil analyst and president of the Petroleum Industry Research Foundation -- meaning struggling airlines would have to compete with the military for fuel, paying higher prices at the worst possible time.

Click here for more on oil prices

"We could see a very large run-up in diesel and jet-fuel prices if we don't plan ahead," Goldstein said -- although he didn't think the spike would last long.

Goldstein and other analysts pointed out that the world is quite different in 2002 than it was in 1990-91, with more oil flowing from Latin America, Canada, Russia and other regions, and that a war's impact on oil prices would be brief and relatively painless.

"In August 1990, when Iraq invaded Kuwait, it took other OPEC countries several months to respond to the supply loss," Goldstein said. "This time, within weeks, if not days, countries like Algeria would respond much more quickly. Within a relatively short period of time, the supply loss would be more than fully made up."

And a successful attack, followed by a successful re-building effort, could have an additional, lucrative bonus.

"If we have a friendly regime in Iraq, if we one way or another control the oil in Iraq, we can control the price of oil," said Robert Goodman, chief economist at Putnam Investments.

An Iraqi war would require the United States to spend money on materiel, personnel and other fixed costs. Michael O'Hanlon, a senior fellow in foreign policy studies at the Brookings Institution, estimates the United States would incur a one-time cost of between $30 billion and $50 billion and pay between $5 billion and $20 billion per year for every year of occupation after the war.

But these costs would count as government spending, giving a boost to gross domestic product (GDP), the broadest measure of the U.S. economy.

Oil at $50 a barrel?

The consensus expectations about the economic impact of a war with Iraq assume the United States wins quickly and installs a friendly government that's able to hold the country together.

These could be dangerous assumptions to make, especially when confronting an enemy like Hussein, who has proven himself capable of doing anything necessary to stay in power.

"If you're Saddam, you'll try to do as much damage as possible. How can he pose heavy damage? By trying to get crude prices as high as possible," said Fadel Gheit, oil analyst at Fahnestock & Co. "He can try to sabotage oil lines through Saudi Arabia, Kuwait and the United Arab Emirates ... or some anarchist will do it on his behalf, with his financing and blessing."

Click here to check oil stocks

Of course, the U.S. and Saudi governments already have thought about this and have taken precautions to protect the oil infrastructure in Saudi Arabia and other Arab nations in the region.

But Gheit pointed out that Osama bin Laden has specifically cited U.S. assistance to the Saudi royal family as one source of his hatred of the United States, that 15 of the 19 hijackers who flew planes into American targets on Sept. 11 were Saudi nationals, and that there is much resentment among Saudis against the Saudi government.

"These people hate their government, they're fanatics and they're very easily persuaded," Gheit said. "My fear is that people who hijacked planes in our own country can do [something similar] much more easily in their own back yard."

"If exports from Saudi Arabia are disrupted -- and they've never been disrupted before -- then we're talking about $50 a barrel for oil," Gheit added.

The CNN effect

And there's no guarantee the war itself will be an easy victory. "Victory" in this case would be nothing less than the removal of Hussein -- preferably involving his verifiable death or capture -- from power, and simply dropping bombs and running the Iraqis away from Kuwait did not accomplish that in 1991.

More likely, a successful war would involve large numbers of ground troops -- and the possibility of large numbers of American casualties, which could hit consumer confidence.

"A protracted war with lots of casualties is not going to be particularly good on the consumer spending side," said Joel Naroff, chief economist and president of Naroff Economic Advisors Inc.

Naroff pointed out that, even if there weren't large numbers of casualties, there could be a repeat of what he called 1991's "CNN effect," when consumers -- whose spending makes up about two-thirds of the total U.S. economy -- stayed glued to their TV sets during the initial stages of the Gulf War, keeping them out of the malls.

Though spending likely would bounce back once the war was over, there still would be potential pitfalls in a post-war Iraq, including the chance of violence against the Kurdish ethnic group in northern Iraq and conflicts between Shiite and Sunni Islamic factions in other parts of the country.

"We'd better have a plan," said Gheit of Fahnestock & Co. "Having a plan does not guarantee success, but not having plan guarantees failure."

|