NEW YORK (CNN/Money) - Oil prices leaped to their highest levels in a year and gold moved to fresh six-week highs in European trading Friday as the United States and its loyal ally Britain began a feverish round of consultations to overcome opposition to a possible war on Iraq.

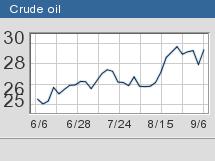

New York crude futures surged above $30 a barrel, just under recent 18-month highs, while in London Brent crude jumped well over a dollar to peak at just under $29, its highest level since soon after the Sept. 11 attacks last year.

"The war drums are pushing the price [of oil] higher, but the global market has been tightening since the second quarter and this will continue into the winter,'' said Leo Drollas of the Center for Global Energy Studies in London.

He predicted the Brent price would rise to near $30 a barrel by the end of the year even without an attack. Tough output curbs by the Organization of the Petroleum Exporting Countries have coincided with a sharp recovery in global oil demand, which analysts expect to accelerate by the end of the year.

Meanwhile, spot gold closed in Europe at $319.55 a troy ounce, up from the New York close on Thursday of $318.57.

The metal hit a session best of $322.90 Friday in New York, its strongest level since July 23, but gains in Wall Street stocks on the back of an upbeat U.S. jobs report dented buying in the safe-haven asset, bringing it to a close of $321.50.

"Gold looks set to be supported and set to move higher as we approach the anniversary of the 9/11 attack on the U.S. and the expectations of an attack on Iraq intensify," said John Reade, metals analyst at UBS Warburg.

The U.S. military said its warplanes attacked an air defense target in a "no-fly" zone of southern Iraq on Thursday in response to recent attempts to shoot down planes monitoring the zone.

The U.S. army recently moved heavy weapons and supplies from Qatar to Kuwait near Iraq to test required mobility if U.S. President George W. Bush ordered preparations for war, Army Secretary Thomas White said on Thursday.

Earlier this week, Bush talked tough against Iraqi President Saddam Hussein after meeting with U.S. congressional leaders. Next week, he will speak before the United Nations, where he will make his case before world leaders on his goal to oust Saddam, accused by the U.S. of building weapons of mass destruction and backing terrorism.

"Investors continue to seek gold's safe-haven properties, as U.S.-Iraq tensions rise ahead of the September 11th anniversary," said James Moore, metals analyst at TheBullionDesk.com.

Gold's latest gains put the metal 17 percent higher than at this time last year, making it one of the strongest performing financial assets.

--from staff and wire reports

|