NEW YORK (CNN/Money) -

Honeywell International Inc., the diversified manufacturer, warned Thursday that current-quarter and full-year profits will fall short of Wall Street forecasts because of the stubborn slowdown in the airline business.

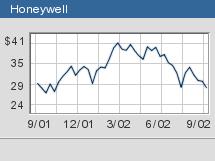

The news, released after the closing bell, sent shares of Honeywell (HON: Research, Estimates) down $3.09, or 11 percent, to $25.25 in after-hours trading, widening the stock's year-to-date loss to 25 percent.

Morristown, N.J.-based Honeywell, whose products include aircraft engines, wheels and brakes, said full-year profits could come in as low as $2 a share. Third-quarter earnings will range from 50 to 52 cents a share.

Analyst surveyed by First Call expected Honeywell, on average, to earn $2.27 a share this year and 60 cents a share in the third quarter.

"We are revising our 2002 outlook because it is clear that the broad economic recovery is not materializing," Honeywell Chairman and CEO Dave Cote said in a statement. "The anticipated second-half improvement in the commercial aerospace aftermarket has stalled as airlines continue to struggle with their profitability, in turn affecting the demand for our products."

US Airways filed for bankruptcy protection in August and airlines have been cutting routes amid a travel slowdown that has led to billions of dollars in losses for the industry.

Still, Honeywell, which also makes specialty chemicals, fibers, plastics and electronics, said it continues to project a record $1.8 billion in cash flow for 2002.

Honeywell, a member of the Standard & Poor's 500, is also one of the 30 stocks in the Dow Jones industrial average.

The company is one of the few diversified manufacturers to warn during what is typically the beginning of a busy stretch for third-quarter pre-announcements. Walt Disney, Oracle and Apple Computer have recently said that quarterly results would fall short.

|