NEW YORK (CNN/Money) -

Philip Morris, the No. 1 cigarette maker, slashed its 2002 profit forecast Thursday, saying it expects earnings-per-share growth of as little 3 percent this year because of sluggish sales and higher spending on promotions.

Analysts surveyed by First Call expected that profit from the maker of Marlboro, Virginia Slims and Parliament cigarettes would rise 19 percent this year, to $4.82 per share.

The news, released after the closing bell, sent shares of Philip Morris tumbling $4.98, 12 percent, to $37.75 in after-hours trading.

Losses in Philip Morris, a member of the Dow Jones industrial average, could hurt that index Friday following two consecutive double-digit point gains.

In warning, Philip Morris blamed weak economic conditions, sharp increases in state taxes on cigarettes, and heightened consumer "frugality."

The company also cited faster-than-expected growth of cheap imports and an influx of illegally sold cigarettes.

In New York City, a pack of cigarettes goes for $7.50, encouraging a nascent black market in cigarettes bought in lower-tax states and Indian reservations and resold by unlicensed vendors. Philip Morris said sales of counterfeit cigarettes are also a problem.

The business has become "more challenging in the last few months" Marlboro CEO Louis Camilleri said in a conference call with analysts.

Camilleri added that in August, the average state excise tax of 65 cents per pack was up 35 percent since June.

Authorities, he said, are working to crack down on illegally sold cigarettes, "including illegally sold Marlboros."

At the same time, Camilleri blamed the lowered profit outlook on weak spending by consumers suffering from a sluggish economy.

Philip Morris joins a growing list of blue chip companies cutting forecast this month. J.P. Morgan Chase, (JPM: Research, Estimates) McDonald's (MCD: Research, Estimates) and Honeywell (HON: Research, Estimates) have all disappointed investors in recent weeks.

Philip Morris said this year's profit will rise between 3 percent and 5 percent. But for the third quarter, the company expects to top First Call's consensus estimate of $1.25 per share by a penny.

Philip Morris (MO: Research, Estimates), based in New York, reports detailed third-quarter results on Oct. 17.

The company's after-hours stock losses spread to rival R.J. Reynolds (RJR: up $1.24 to $46.55, Research, Estimates), which makes Camel, Winston, and Salem cigarettes. R.J. Reynolds shares slipped $3.31, or 7 percent, to $43.25 in late trading Thursday.

While Philip Morris said its cigarette market share fell to a low of 49 percent in July, it has been rising slightly, to 49.2 percent in mid-September.

"I believe we can continue to gain share," Camilleri said.

The company, which expects 2003 earnings growth of 8 percent-to-9 percent, said it will spend more than $6 billion to buy back stock this year.

"We believe industry dynamics should improve in 2003, " said Camilleri, in part because of "more effective measures to stop the flow of illegally sold cigarettes."

Philip Morris holds a 83.9 stake in Kraft Foods (KFT: Research, Estimates), which makes Kraft cheese, Maxwell House coffee, Nabisco cookies, and is the biggest shareholder of brewer SABMiller. Those businesses, the company said, are in good shape.

Investors have generally flocked to Philip Morris for the profit it pays out to shareholders. The company in August raised its quarterly dividend to 64 cents a share, making it one of the highest yielding large capitalization stocks.

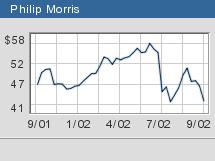

Its shares have held up better than many this year. Philip Morris stocks was off 6.8 percent this year through Thursday's close, a figure that could widen by the closing bell Friday.

|