NEW YORK (CNN/Money) -

Treasury bonds rallied anew Friday as investors yet again fled stocks and steered cash into the perceived safety of U.S. government securities.

"It's the same old theme of the asset allocation story," said Dominic Konstam, head of interest-rate strategy at Credit Suisse First Boston. "Institutions are still chronically overweight equities compared with fixed income and the asset reallocation is still unraveling. We reckon we are about two-thirds of the way through it."

Five- and 10-year U.S. Treasury yields, which move in the opposite direction of prices, fell to their lowest levels since 1958. Two-year notes and 30-year bonds had their lowest weekly closes since the 1970s, when the maturities were first issued.

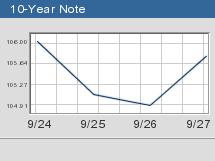

Around 4:30 p.m. ET, the benchmark 10-year note jumped 29/32 to 105-27/32, lowering its yield to 3.66 percent from 3.77 percent late Thursday.

The five-year note added 21/32 to 102-19/32, taking yields to 2.68 percent from 2.83 percent, while the 30-year bond gained 25/32 to 110-26/32 yielding 4.68 percent from 4.73 percent.

At the short end, the two-year note rose a substantial 12/32 to 100-5/32 dragging yields to 1.8 percent from 1.99 percent, widening the gap between two- and 30-year yields to 286 basis points from 274 earlier in the week.

"We (were) supported by the weak equities, some of the downgrades in some of the stocks and some of the weak earnings and layoff announcements," said Ken Logan, market analyst at Thomson/IFR. "It sort of fits into the market's macro bias, which is still one of a weakening stock market, poor earnings and potentially a weaker fourth quarter coming up."

Not only did the world's largest cigarette maker, Philip Morris Cos. (MO: Research, Estimates) downgrade its full-year outlook, but telephone company SBC Communications Inc. (SBC: Research, Estimates) shed 11,000 jobs and Lehman cuts its rating on General Electric Co. (GE: Research, Estimates).

At some points during the session, shorter-dated paper outperformed longer-dated securities, as month-end buying and anticipation of a potential interest rate cut boosted the front end of the yield curve, the graph that plots the different returns of various government-backed fixed-income securities.

Lehman's benchmark Treasury index's duration, a measure of a portfolio's sensitivity to interest rates, is expected to fall in September after rising sharply in August. Fund managers tracking the index needed to trim the average maturity of their portfolio, so they sold longer-dated paper to buy shorter-dated maturities to bring their duration back in line.

The latest U.S. economic data were a bit more upbeat than expected, as were other economic reports released this week. But that did not deter bond prices from their upward path.

The final reading for the University of Michigan's consumer confidence index saw a dip to 86.1 in September from 87.6 the month before, while analysts had looked for 85.9.

The final estimate for second quarter U.S. gross domestic product growth saw a modest upward revision to 1.3 percent annualized from 1.1. percent, mainly thanks to stronger exports.

"It was the third look at GDP. Everything in it was basically known," said John Canavan, market analyst at Stone & McCarthy. "In addition ... it was second quarter data -- they were old numbers."

In the currency market, the euro was trading around 98.06 cents, slightly higher on the day, and off session lows near 97.50 cents it hit after the U.S. consumer data.

The dollar, however, gain strength against the Japanese currency, breaking above �123, but drifted back in late afternoon trading to �122.7.

-- from staff and wire reports

|