NEW YORK (CNN/Money) -

Sometimes the only way to win in sports is to get out of the game.

That certainly appears to be the case for some involuntary sports participants -- shareholders in public companies that own teams.

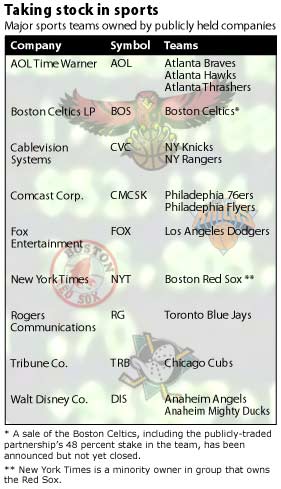

There are a dozen teams, most of them reported to be money losers, that are majority-owned by publicly traded companies that should be getting very few cheers from their shareholders.

Besides the issue of the companies subsidizing ongoing losses, it's also questionable whether the market is giving the companies the proper value for their ownership of the teams. That suggests that the sale of the teams would unlock a lot of trapped value. At one point this summer, the $669 million estimated combined value of the New York Knicks and Rangers equaled about 82 percent of the market value of all the stock of the teams' owner Cablevision Systems (CVC: Research, Estimates).

Forbes estimates that the major sports teams controlled by public companies are worth a total of $3.2 billion. A sale of these teams could probably fetch even more than that, besides ending the drain on the bottom lines, due to the vanity or prestige premium paid by buyers of sports teams.

All the companies that own teams today are media companies that believe that such terms as convergence and synergy justify their continued money drain by the teams. But companies outside the world of media that used to own teams, such as brewers, figured out years ago that it makes more sense to give up an ownership stake and have their business relations limited to being a sponsor and supplier.

Disney, AOL weighing team sales

There's signs that media companies are slowly coming to that realization as well. Walt Disney Co. (DIS: Research, Estimates) has hired Lehman Brothers to explore the sale of its two sports teams -- baseball's Anaheim Angels and hockey's Anaheim Mighty Ducks.

Richard Parsons, CEO of AOL Time Warner (AOL: Research, Estimates), last week identified his companies three Atlanta-based teams - the Braves baseball team, Hawks basketball team and Thrashers hockey team -- as the type of "non-core" assets it might consider selling in order to strengthen its balance sheet.

| SportsBiz

|

|

|

|

|

And in the spring Alan Horn, chief financial officer of Canadian media company Rogers Communications (RG: Research, Estimates), said that if the company couldn't stem losses from the Blue Jays he estimated at $55 million, then the company would have to "look at other alternatives."

Officials with the AOL teams and the Blue Jays insist there is no discussion of a sales there, though.

"No one likes losing money. But I've never heard them indicate whatsoever they are going to sell the ball club," Blue Jays CEO Paul Godfrey told me. "The alternative is not selling the club; it is reducing costs, increasing revenue, and I think we're well on the way of doing that."

Stan Kasten, who runs the three Atlanta teams for AOL, concedes the teams are not core assets to the media/Internet conglomerate, which is also parent of CNN/Money. But he insists there have been no discussions or demands to sell the teams. And he doesn't think Disney's plans to sell its teams necessarily means AOL will follow suit.

| Related stories

|

|

|

|

|

"I think it's difficult to generalize about ownerships," Kasten said when I asked if there was greater pressure on public companies to divest money losing teams. "Disney doesn't own an arena in which its teams are tenants. It doesn't provide programming for its own network. You have to keep the differences in mind."

Marc Ganis, president of sports consultant SportsCorp Ltd., said that the failure of Disney to establish a regional sports network in Southern California with its ESPN brand means it makes sense for Disney to sell its teams. He also thinks there's less of a business reason for AOL to hang onto its teams, given the current configuration of the company.

But Ganis said ownership of the Los Angeles Dodgers baseball team by Fox Entertainment Group (FOX: Research, Estimates) was necessary for it to ensure programing for its Southern California regional sports network, which is a success, even if the Dodgers continue to lose money.

"Fox just had to overpay on a rights fee basis for the Celtics games in order to keep the lights on the Boston market," said Ganis. "So they're saving a lot of money owning the Dodgers. If the Dodgers' broadcast rights were up for public bid right now, they could go to an astronomical sum, and that would mean either a loss of programming for Fox or far greater costs."

Still, the Dodgers' annual broadcast revenue is only $27 million. Even if that doubled to near the Yankees' broadcast revenue number, the additional cost to Fox would be less than the team's reported loss of $68.9 million.

Even for media companies with an eye on "convergence," it seems like the best move for most shareholders is for their company to get out of the game while they have a chance.

|