NEW YORK (CNN/Money) -

Continued worries about consumer spending, corporate profits, and potential military action in Iraq pushed stocks sharply lower Monday, overshadowing any relief regarding President Bush's intervention in the West Coast port dispute.

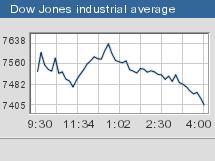

The Dow Jones industrial average (down 105.56 to 7422.84, Charts), the Standard & Poor's 500 (down 15.30 to 785.28, Charts) and the Nasdaq composite index (down 20.50 to 1119.40, Charts) all closed with sharp declines. The major indexes have been falling for six weeks straight. The Dow is currently at levels not seen since November 1997, while the Nasdaq is at lows not seen since August 1996.

For much of the day's early trading, the Dow managed to perform better than other indexes. But the blue-chip average slipped into negative territory around midday and never bailed out, joining a weak Nasdaq.

While Intel's CEO offered some positive forward-looking guidance, Cisco's CEO countered that with worries about visibility. A profit warning from Sears triggered a retail selloff, while mixed messages from the financial sector left American Express and other stocks largely lower.

Adding to the selling was a report released an hour before the close of trade showing that August consumer borrowing rose by the smallest amount in eight months, with a rise of just $4.2 billion, when economists surveyed by Briefing.com were expecting a rise of $11.1 billion.

The news is alarming, analysts said, because if consumers are borrowing less, that implies a slowdown in consumer spending, which is responsible for fueling two-thirds of the economy. Consumer spending has also held up well, despite the recent slowdown in the economic recovery.

"If the consumer starts to cave in, the 'double dip' aura will come back. I think that (the Consumer Credit report) is what created this final selling," Larry Wachtel, market analyst at Prudential Financial, told CNNfn's Street Sweep.

Investors may have also been hesitant to act ahead of President Bush's address on Iraq, scheduled to begin at 8 p.m. ET. Bush is expected to answer recent criticism by outlining specific ways in which Iraq has violated United Nations disarmament resolutions.

"If we get any kind of word that we can avert military action, avoid a war, certainly that would be helpful," Wachtel added.

There are no economic reports and few profit reports expected Tuesday.

"Until we get some sort of clear-cut message about where we're going in terms of the conflict with Iraq, the economic slowdown and corporate profits, fiscal policy, and everything else, we're going to keep seeing this kind of action," said Scotty George, chief investment officer at Corinthian Partners Asset Management.

Intel, Cisco, offer conflicting tech picture

The CEO of No. 1 chipmaker Intel (INTC: up $0.11 to $13.82, Research, Estimates) said Sunday that he was more optimistic than ever about the tech sector and that the current crisis should end by early next year. The stock saw a mild boost on the news but failed to spark a tech rally.

The rest of the chip sector fell on a downgrade from Prudential Financial. The brokerage firm lowered its chip industry rating to "market perform" from "market outperform." The firm also cut its 2003 profit estimates and downgraded its rating to "hold" from "buy" on select companies, including Broadcom (BRCM: down $0.41 to $9.70, Research, Estimates) and LSI Logic (LSI: down $0.42 to $5.23, Research, Estimates).

Shares of networking gear maker Cisco Systems (CSCO: down $0.38 to $9.08, Research, Estimates) also hurt techs after Deutsche Bank cut 2002 and 2003 earnings-per-share estimates, citing the worsening technology environment. Profit estimates on Juniper Networks (JNPR: down $0.38 to $4.43, Research, Estimates) and Foundry Networks (FDRY: down $0.76 to $5.26, Research, Estimates) were also cut.

Separately, John Chambers, Cisco's CEO, said at a conference that customers' visibility into how their business is doing is "getting tighter," and that a service provider recovery will lag an information technology recovery. He also said that the company is seeing more competition from Dell Computer (DELL: up $0.19 to $24.95, Research, Estimates).

Shares of financial services provider J.P. Morgan Chase (JPM: up $0.23 to $16.77, Research, Estimates) managed a slight gain despite reports that the company will cut about 4,000 investment banking jobs. In addition, the sector got a little boost after Federal Reserve Chairman Alan Greenspan made some positive comments about banks at an industry conference.

However, many other stocks in the financial services sector traded lower, including Dow component American Express (AXP: down $1.93 to $26.60, Research, Estimates), after Goldman Sachs cut its ratings on financing firms such as Capital One Financial (COF: down $2.32 to $28.06, Research, Estimates).

Also pressuring the Dow was home improvement retailer Home Depot (HD: down $1.59 to $24.21, Research, Estimates), which declined with the rest of the sector after fellow retailer Sears Roebuck (S: down $5.39 to $32.25, Research, Estimates) warned that third-quarter results will miss estimates.

On a positive note, shares of No. 1 cigarette maker Philip Morris (MO: up $1.99 to $38.58, Research, Estimates) bounced back after their selloff Friday, when the company was ordered to pay a record $28 billion to a 64-year-old woman with lung cancer. The woman had argued that her tobacco addiction was due to inadequate warnings from the company about the risks of cigarettes. But analysts speculated that the figure would be scaled back substantially following appeals.

"We're really testing the patience of investors who have lost substantial sums of money," added Corinthian Partners' George. "We're also testing technical levels, with stocks expanding or retracting as we get near key lows."

West Coast port dispute, Iraq among factors

Just as the markets were opening, administration officials said Bush will appoint a board of inquiry to determine the economic impact of the West Coast port lockout, which has lasted more than a week.

Blue chips rallied on the news, but seesawed as the day went on as investors struggled with the same concerns that have led to six straight weeks of stock losses.

"We had a little surprise with the Bush announcement right away and that gave us a little hope, but the market is still faced with all the same problems that have hurt us for weeks," said Peter Cardillo, director of research at Global Partners Securities. "We still have a market that is stuck in a downward trend with the technicals getting weaker."

Attempts to resolve the West Coast port labor dispute took a turn for the worse after talks between the longshoremen and shipping lines broke down late Sunday, when negotiators for the International Longshore and Warehouse Union rejected the Pacific Maritime Association's latest offer.

Cargo ships have been unable to load or unload at the ports since Sept. 29, when management resumed a lockout that had ended earlier in the day. Experts estimate that the lockout is costing the U.S. economy $2 billion a day, during a time when the economy is struggling to break out of a slowdown.

"The economy is already weak and this is adding to the woes," Cardillo added. "It's a lose-lose situation. If the situation is settled soon, we go back to the same soft economy. If the situation is not settled soon, we get an even softer economy."

European markets closed modestly lower. Asian-Pacific stocks also fell Monday, with Tokyo's Nikkei index down 3.8 percent to a 19-year low on concern about Japanese bank loans.

Treasury prices rose, sending the 10-year note yield down to 3.60 percent from 3.67 percent late Friday. The dollar was weaker versus the euro but stronger against the yen.

Light crude oil futures rose 2 cents to $29.64 a barrel, while gold was lower. World oil prices gained as news of a suspected terror attack on a French oil tanker off Yemen created concern of supply disruptions from the Middle East.

Market breadth was negative. On the New York Stock Exchange, losers topped winners by more than 3-to-1 as 1.54 billion shares changed hands. On the Nasdaq, decliners beat advancers by more than 12-to-5 as 1.38 billion shares traded.

|