NEW YORK (CNN/Money) -

U.S. stocks got pummeled Wednesday as concerns about profits at General Electric and in the automotive sector added to the deep investor pessimism that has trounced the market for the past six weeks.

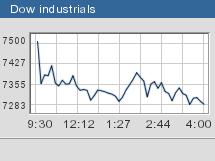

The Dow Jones industrial average (down 215.22 to 7286.27, Charts), the Standard & Poor's 500 index (down 21.79 to 776.76, Charts), and the Nasdaq composite index (down 15.10 to 1114.11, Charts) all suffered substantial losses, with the Dow and S&P getting hit the hardest.

The Dow fell ever closer to a five-year low, while the Nasdaq hit a new six-year low. The S&P 500 closed at a 5-1/2 year low, just a fraction above the intraday low of July 24, 2002, a level that had been seen by some as a potential bottom. Extreme selling in energy and utilities brought the Dow Utilities (down 17.82 to 167.57, Charts) index to a more than eight-year low.

In addition, the Wilshire 5000 Total Market index closed at 7,342.84, down nearly 3 percent, or $300 billion in market value. The index is down 50.22 percent from its high of 14,751.64 on March 24, 2000. Since that date, approximately $8.5 trillion in market value has been erased. Year-to-date, the Wilshire 5000 has decreased by 31 percent or approximately $4 trillion in market value.

"I don't know if we've seen the end of the selloff, but we're getting pretty close. The sentiment is so bad that we're getting near a bottom," Peter Costa, a principal at Francis P. Maglio & Co., told CNNfn's Street Sweep.

After the close of trade, Internet media company Yahoo! (YHOO: up $0.47 to $9.98, Research, Estimates) reported third-quarter profit of 5 cents a share, a penny above estimates, and also raised its revenue forecast for 2002.

"The Yahoo! news is positive, but I don't know how much it's going to weigh on the market," Costa added.

Heavy selling in a few influential companies following negative brokerage calls and other news pushed the Dow industrials and S&P 500 sharply lower Wednesday, while the Nasdaq suffered slightly lighter declines.

"There's just so many negative stories out there today, between GE, GM, Ford, the ports, Iraq, the foreign markets. What you're seeing is a total, absolute lack of faith in financial markets insofar as the average American investor is concerned," said Tom Schrader, head of listed trading at Legg Mason.

Morgan Stanley cut its 2003 earnings-per-share estimate on conglomerate General Electric (GE: down $1.35 to $22.00, Research, Estimates) due to a decline in GE's power and aerospace markets and worries about potential losses in its financial services arm. In addition, GE's jet engine division said it will cut 1,000 jobs by the end of the year and up to 1,800 additional jobs in 2003 due to a slump in the airline industry.

Selling of automakers' stocks remained a major market pressure point for the second session in a row. On Wednesday, Lehman Bros. lowered its free cash flow forecast over the period of 2003 through 2006 by $4.5 billion for General Motors (GM: down $2.59 to $31.01, Research, Estimates), and cut the company's stock price target to $38 from $41, citing the diminished value of GM's Hughes stake and an expected cash drain from the anticipated Fiat acquisition.

Shares of Ford Motor (F: down $0.60 to $7.15, Research, Estimates) and DaimlerChrysler (DCX: down $2.07 to $30.17, Research, Estimates) declined as well. Salomon Smith Barney removed Ford from its "recommended list" Wednesday. On Tuesday, Credit Suisse First Boston downgraded the auto sector amid other negative brokerage notes.

"In terms of stocks, GE is the biggest problem today, as is the American automobile sector," said Jon Burnham, portfolio manager at Burnham Securities. "You've got Ford trading at $7 a share, that's practically bankruptcy level for a company that is not in danger of declaring bankruptcy. And when GE, one of the great, major companies of the world is down, it has a big impact on the psychology."

Financial stocks were lower. Moody's Investors Service cut J.P. Morgan Chase's (JPM: down $1.15 to $15.45, Research, Estimates) long-term debt ratings, which will affect about $42 billion of debt, due to concerns about the No. 2 bank's medium- and long-term outlook.

Shares of Merck (MRK: down $0.37 to $45.63, Research, Estimates) managed to close off of its worst lows after the company reaffirmed late afternoon that it will meet 2002 and 2003 profit targets. The stock had fallen sharply throughout the day, hurting the drug sector, after brokerage house Raymond James downgraded it, arguing that the company is likely to issue an earnings warning by December.

HP sees no pickup in 2003

After managing a more mixed performance for most of the morning, the techs joined the other sectors in the red by early afternoon.

Hewlett-Packard (HPQ: down $0.38 to $11.16, Research, Estimates) is not counting on a pickup in the technology industry in 2003, a senior executive of the computer hardware and printer maker said late Tuesday. The company also said its customers' spending plans remain flat for the new year, barring any substantial economic improvements.

A strong recovery for personal computer makers and for tech as a whole is dependent on a pickup in customer orders; HP's comments add to the general pessimism regarding the timeline of that pickup.

Shares of Microsoft (MSFT: down $1.00 to $43.99, Research, Estimates) fell, but were well off their lows for the session. The No. 1 software maker's earnings may be hurt by the cancellation of a tax law, the Extraterritorial Income Exclusion Act, due to a World Trade Organization ruling, CIBC World Markets said in a morning note. The change could affect a number of big companies, such as Boeing (BA: down $1.57 to $30.44, Research, Estimates), Walt Disney (DIS: down $0.45 to $14.20, Research, Estimates) and others.

In terms of Microsoft specifically, the company benefited by 6 cents per share from the act in 2002, CIBC said -- and while it is not changing estimates on Microsoft now, it's cutting the company's stock price target to $57 from $65.

But selling in techs and on the Nasdaq was tempered by shares of No. 1 networking gear maker Cisco Systems (CSCO: up $0.63 to $9.23, Research, Estimates), which bounced off its sharp declines of the past few sessions, helped by brokerage Needham; the firm raised its rating to "strong buy" on valuation. Sun Microsystems (SUNW: up $0.20 to $2.67, Research, Estimates) and Intel (INTC: up $0.24 to $13.46, Research, Estimates) also bounced off recent lows, adding support.

In economic news, West Coast ports were expected to reopen later Wednesday after a federal judge approved President Bush's request under the Taft-Hartley Act for a temporary stop to the nine-day lockout. The dispute has kept cargo ships from loading and unloading, and has cost the economy as much as $2 billion a day.

Anticipation ahead of the development gave stocks a push Tuesday, but failed to extend the same benefits on Wednesday as analysts and market watchers worried about the impact of the shutdown on retailers, transportation stocks and other companies hurt in the lockout. Experts estimate it will take up to six weeks just to unload the backlog of products that were in limbo.

"This kind of news makes the market feel better for the moment, but when you're in this kind of bearish trend, some small concession isn't going to reverse direction. A lot of people thought Bush should have acted sooner," said Burnham Securities' Jon Burnham. "Even with this moving forward, the market has other things to worry about, like the economy, corporate profits and Iraq."

Another factor in trade: noted Goldman Sachs strategist Abby Joseph Cohen, once one of Wall Street's most renowned bulls, cut her 12-month target on both the Standard & Poor's 500 and the Dow Jones industrial average. Cohen said that equity prices have been undermined by the uncertainty surrounding the economy and corporate accounting woes, among other factors. However, she also said that stocks are undervalued, profits are slowly rising and the worst is behind us.

Although a comment from the strategist once had an immediate effect on trading, it did not seem to have as much of an effect in light of the broad-based negativity.

"I'm trying to stay positive but it's really hard," said Legg Mason's Schrader. "I guess one silver lining is that October, historically, has often been a period when we've been able to put in a good bottom and see real capitulation. We've already hit several lows this month and from a technical standpoint, it looks like because we are at such extreme levels, we really could see some sort of rally before the end of the year."

Treasury prices rallied, sending the 10-year note yield down to 3.56 percent from 3.63 percent late Tuesday. The dollar was little changed against the yen, but was weaker against the euro.

Light crude oil futures fell 13 cents to $29.35 a barrel. Gold gained modestly.

Market breadth was negative. On the New York Stock Exchange, losers topped winners by more than 6-to-1 as 1.80 billion shares changed hands, and it was the worst market breadth since August 1998. On the Nasdaq, decliners beat advancers more than 5-to-2 as 1.72 billion shares traded.

|