NEW YORK (CNN/Money) - Internet media company Yahoo! Inc. Wednesday logged a third-quarter profit that topped expectations and raised its revenue forecast for 2002.

After the closing bell, Yahoo! said its earnings for the quarter were $28.9 million, or 5 cents a share. That compares with a net loss of $24.1 million, or 4 cents a share, for the same period last year.

At $248.8 million, Yahoo!'s third-quarter revenue rose 50 percent over the year-ago $166.4 million and topped most analysts' expectations.

By First Call's count, Wall Street analysts generally had been expecting Yahoo! to post a third-quarter profit of 4 cents a share on roughly $238.4 million in revenue.

At the same time, Yahoo! raised the bar for 2002, saying it expects revenue between $930 million and $955 million. The consensus estimate of analysts was revenue nearer $925.9 million.

"We do expect to continue these strong results, and to that end we have upwardly revised our full-year outlook," Terry Semel, who took over as Yahoo!'s CEO in April 2001, said on a conference call Wednesday evening.

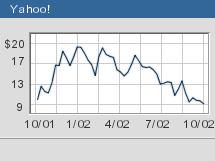

Investors' initial reaction to the results and the more upbeat business forecast was positive. Shares of Yahoo! rose 5.7 percent to $10.55 in heavy after-hours trade after rising nearly 5 percent on Nasdaq ahead of the earnings report.

"Given the current environment, when you've got so many companies doing poorly, to see one come out with this kind of upside surprise really speaks to the traction their strategy has," said Jeffrey Fieler, an analyst at Bear Stearns.

"The forward-looking numbers that they're putting out are beginning to give them more credibility than they had three or six months ago," Fieler said.

Fieler has an "outperform" rating on Yahoo!, and he said the firm does not list Yahoo! among its current investment banking clients.

While online advertising sales still account for the bulk of its revenue, Yahoo! has been moving to diversify its revenue stream. Under Semel's watch, the company has taken a number of concrete steps toward that end.

Among them has been: a revenue-sharing agreement with pay-for-placement search-listing provider Overture Services Inc.; the purchase of HotJobs.com; and building up its portfolio of premium consumer services.

During the third quarter, Yahoo! said revenue from marketing services, which includes online advertising, totaled $147.4 million, up 22 percent from the same period last year.

The company attributed that rise primarily to an increase in revenue from the Overture deal.

Susan Decker, Yahoo!'s chief financial officer, said on the conference call that excluding the revenue from Overture, Yahoo!'s third-quarter marketing services revenue showed a modest decline from a year ago.

At the same time, Yahoo! said fees and listings revenue totaled $83.1 million, a 124 percent increase compared with the same period last year. Excluding HotJobs, which the company did not own a year ago, the increase was 66 percent.

Yahoo! attributed that increase to more paying customers for its fee- and listings-based services, including Yahoo! Personals and its new Internet access service offered in partnership with SBC Communications.

Looking further out, Yahoo! executives said they expect revenue in 2003 to range between $1.08 billion and $1.18 billion, which would yield earnings before interest, taxes, depreciation and amortization between $250 million and $300 million.

The company had not previously made a financial forecast for 2003. At last count, the consensus estimate of analysts polled by First Call was for 2003 revenue of roughly $1.1 billion.

Executives gave few specific details about what will drive that growth, saying only that they expect to gain market share in their core marketing services business while at the same time, deriving more revenue from subscribers to Yahoo! premium services.

The company ended the quarter with some five million subscribers to Yahoo!'s premium services, paying an average $5 per month. Decker said the company is aiming to double that to $10 per month in 2003.

Still, some company watchers were very impressed with the outlook and the tone of Wednesday's conference call.

"I think it's pretty awesome that they can forecast growth of 15 to 23 percent for next year in an advertising market that's still flat," said U.S. Bancorp Piper Jaffray analyst Safa Rashtchy.

"It just shows the strength of their non-advertising revenue," Rashtchy said.

U.S. Bancorp Piper Jaffray has an "outperform" rating on Yahoo!, and the firm does not do any investment banking business with the company.

|