NEW YORK (CNN/Money) -

McDonald's Corp. slashed its fourth-quarter guidance Tuesday, saying it expects to post its first-ever quarterly loss after taking a multi-million dollar charge to pay for job cuts. It also plans to close underperforming restaurants.

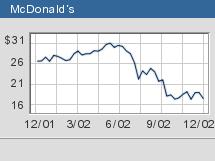

Shares of McDonald's (MCD: down $1.39 to $15.99, Research, Estimates), the most actively traded stock on the New York Stock Exchange, fell $1.39, or 8 percent, to $15.99, widening its year-to-date losses to 39 percent. More than 35 million shares changed hands.

Trying to save money, McDonald's said it will take a $435 charge to close underperforming restaurants and cut jobs, forcing the world's biggest restaurant to lose 5 to 6 cents a share in the fourth quarter ending this month.

McDonald's and other fast food restaurants have become entangled in a price war in recent weeks, trying to outdo one another with dollar-menu items, which at least in McDonald's case, has had a minimal impact on sales and has cut into margins.

Competition in fast food has become keen as more Americans show a taste for so-called "fast-casual" dining where they can sit down for a meal and the food quality is generally better than at a fast-food restaurant.

Peter Oakes, who covers McDonald's for Merrill Lynch, downgraded the stock and cut his price target to $25 a share while lowering his profit forecasts on the company.

"The news was not encouraging," he told clients.

Analysts polled by earnings tracker First Call had expected McDonald's to earn a fourth quarter profit of 31 cents a share for the quarter. Excluding the charges, McDonald's anticipates a profit of 25 to 26 cents a share.

Oak Brook, Ill.-based McDonald's also said it will review additional areas to "sharpen its focus and improve results," which could result in additional fourth quarter charges.

McDonald's also said fourth-quarter margins are expected to be lower than in the same period a year ago. In addition, the company expects a 12 percent increase in spending, mostly for advertising and new technology, compared with a year earlier.

So far in the fourth quarter, McDonald's sales at stores open at least 13 months are down 1.6 percent before the effects of foreign exchange, the company said in an updated fourth-quarter earnings outlook.

Same-store sales in the United States, McDonald's largest market, fell 1.3 percent in October and November and 1.5 percent through the first 11 months of the year, a sign that the company's new discounting strategy is not meeting expectations, analysts said.

"It's clear that the discounting program is not working," said Bear Stearns analyst Joe Buckley, referring to a new "Dollar Menu" McDonald's recently launched to drive up sales. "Improving service is very important for them, I think that's kind of the short-term key."

The disappointment comes during the same month that McDonald's CEO Jack Greenberg said he plans to retire at the end of the year. He will be will succeeded by the company's chairman and president, Jim Cantalupo.

Systemwide sales for the first 11 months of the year rose 2 percent to $37.9 billion, compared with the same period a year ago. U.S. systemwide sales were up 1 percent to $18.6 billion year-to-date through November. European systemwide sales increased 6 percent to $9.5 billion year-to-date through November.

"This has been a difficult year and our financial performance has been below expectations," said Matthew Paull, McDonald's chief financial officer, in a statement.

-- Reuters contributed to this report

|