NEW YORK (CNN/Money) -

U.S. stocks closed higher for the second week in a row, despite a lackluster session Friday amid weak monthly employment numbers and strong tech; whether the good tidings can continue next week depends on the spate of major companies due to issue quarterly results.

Some of the most highly-anticipated reports due next week include: Intel (INTC: Research, Estimates), Microsoft (MSFT: Research, Estimates), Sun Microsystems (SUNW: Research, Estimates), eBay (EBAY: Research, Estimates) and Yahoo! (YHOO: up $0.56 to $20.00, Research, Estimates).

In addition, investors will take in economic reports on retail sales, import and export prices, producer prices, consumer prices, the Federal Reserve's Beige Book and the preliminary reading on consumer sentiment from the University of Michigan.

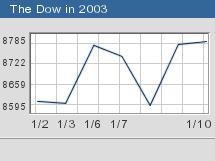

The Nasdaq composite (up 9.26 to 1447.72, Charts) closed modestly higher Friday, while the Dow Jones industrial average (up 8.77 to 8784.95, Charts) eked out the slightest gain and the S&P 500 index (unchanged at 927.57, Charts) ended the day where it began it. Trading was volatile throughout the session, with all three indicators spending time on either side of unchanged.

But after a strong runup Monday ahead of the Bush Administration's announcement of a $674 billion economic stimulus package, and a sharp rally Thursday amid optimism about the economy and technology, stocks managed to end the first full trading week of 2003 with flying colors.

The Dow gained around 183 points, or 2.1 percent, the Nasdaq rose almost 61 points, or 4.3 percent, and the Standard & Poor's 500 index added around 19 points, or 2.1 percent.

For 2003, after the first seven sessions, the Dow is up around 443 points, or 5.3 percent, the Nasdaq is up around 112 points, or 8.4 percent, and the S&P 500 is up around 48 points, or 5.4 percent.

Not bad, considering the mixed news investors have had to digest so far this year.

"Given all the negatives thrown at the market, it's amazing how well it's doing," said Tom Schrader, head of listed trading at Legg Mason.

"I think we're probably looking for another six weeks of fairly good market action just from a technical standpoint, but that's also dependant on a lot," he added. "Chart wise, we look good and this is certainly the season to rally, but there are a lot of contradictions.

Still, stocks struggled to find momentum Friday as investors sorted through the weak monthly employment data amid continued strength in technology shares, an extension of the previous session's gains.

Job cuts worse than expected

Stocks had fallen sharply at the open of trade after the Labor Department said five times as many non-farm payrolls as had been expected disappeared in the last month of 2002, keeping the unemployment rate at 6 percent. To make matters worse, the November job loss number was revised to 88,000 from 40,000.

But investors quickly recovered from what some analysts described as a knee-jerk reaction to the news.

"I'm not so worried about a drop in non-farm payrolls. Employment is a lagging indicator. As the economy starts to recover, output starts to increase, [and] employment will pick up," said Michael Carty, principal at New Millennium Advisors.

The market's ability to digest and essentially shrug off the mixed economic news is a positive, Carty said, as it shows an improvement in sentiment. "Investors are waking up and realizing that equities are a good place to be right now," he said.

Technology stocks help Nasdaq

Semiconductor and networking stocks helped the Nasdaq stay mostly on solid ground.

Shares of Applied Materials (AMAT: up $0.66 to $15.70, Research, Estimates) rose more than 4 percent after USB Piper Jaffray raised its fiscal-year 2003 revenue and earnings-per-share estimates, and its price target, on the chip gear maker. The firm cited its belief that the company will see a pickup in orders by late spring or early summer.

Additionally, Lehman Bros. analyst Dan Niles issued a note saying that despite a soft finish in December, he believes Advanced Micro Devices (AMD: up $0.50 to $7.41, Research, Estimates) hit Lehman's fourth-quarter targets. He also said that Intel (INTC: up $0.36 to $17.42, Research, Estimates) should met Lehman's targets, although he expects the firm to offer conservative first quarter guidance. Intel is a member of the Dow industrials and one of the Nasdaq's most heavily-weighted issues.

Networking stocks built on their Thursday gains, which had stemmed from a positive pre-announcement out of Foundry Networks (FDRY: up $0.10 to $9.53, Research, Estimates). The Amex Networking index rose 4.8 percent with Cisco Systems (CSCO: up $0.27 to $15.22, Research, Estimates) and Lucent Technologies (LU: up $0.05 to $1.70, Research, Estimates) leading the charge.

"Tech has been so weak for so long that no one wanted to touch it. But people are looking at it again," New Millennium's Carty observed. "Although the tech picture looked bleak for the last three years, people are seeing that there are going to be survivors, the leaders in the sectors."

On the downside, shares of United Technologies (UTX: down $0.62 to $64.32, Research, Estimates) weighed on the Dow. The aircraft parts maker said late Thursday that it has added another $500 million in a cash payment to its U.S. pension plan, for a total of $1.5 billion in cash and stock added over the past 14 months.

UTX is only the latest company that has had to combat shortages in its pension plan as stocks kept falling in the past few years.

Shares of printer maker Lexmark (LXK: down $4.00 to $62.26, Research, Estimates) dropped more than 6 percent after the company said late Thursday that its first-quarter profit will likely fall below Wall Street forecasts.

Market breadth was barely positive. On the New York Stock Exchange, advancers narrowly edged decliners as 1.47 billion shares changed hands. On the Nasdaq, winners edged losers 6 to 5 as 1.63 billion shares traded.

Bonds ticked modestly higher, pushing the benchmark 10-year note yield down to 4.14 percent from 4.17 percent late Thursday. Treasury prices and yields move in opposite directions. The dollar once again gave back some ground against the euro and the yen.

Light crude oil for February delivery fell 31 cents to $31.68 a barrel in New York. Gold for February delivery added $1.20 to $354.90 an ounce in New York.

|