NEW YORK (CNN/Money) -

General Electric said Wednesday that profits in the latest quarter and full year should meet Wall Street forecasts in an announcement that sent the company's shares up nearly 4 percent.

Speaking to analysts and investors, Chief Financial Officer Keith Sherin said GE's 2003 earnings per share should range from $1.55 to $1.70. Profits in the first quarter ended last month are targeted at 32 cents per share, Sherin said.

Sherin, who called the economic environment difficult, said weakness in the company's gas turbine business and rising pension costs will be offset by strength in its engines and medical equipment lines.

"We're still in range for the total year," Sherin said. "GE's strengths have allowed us to perform in a difficult environment."

The company, which also sells reinsurance, runs NBC, and makes light bulbs, is updated analysts and investors during a half-day presentation Wednesday.

GE is expected to earn 32 cents per share in the first quarter and $1.62 per share this year, according to the consensus forecast of analysts surveyed by First Call.

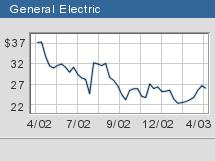

Shares of GE (GE: Research, Estimates) based in Fairfield, Conn., rose 92 cents, or 3.6 percent, to $27.05 Wednesday.

GE's power systems business, whose profits are expected to decline sharply this year on slackening demand for gas turbines, is doing better than expected, Sherin said. But GE's plastics business is suffering because of the higher price for oil, a key raw material, which has cut into profit margins.

And the impact of the war in Iraq has been tougher than what had been expected on its NBC television business. NBC's ad revenue is hurt when it pre-empts the broadcast of popular TV programs for war coverage.

Wall Street's forecast for the year would mean a 7.8 percent profit gain over 2002, when earnings were $1.51 per share. But first-quarter profits of 32 cents a share would be a 9 percent drop from the year-ago quarter.

-- Reuters contributed to this report

|