SAN FRANCISCO (CNN/Money) -

If it's possible to feel sorry for someone like Oracle CEO Larry Ellison, now is the time.

The recently married multibillionaire sailor rapscallion finds himself in an unfamiliar position: not getting what he wants. His attempt to acquire PeopleSoft (PSFT: Research, Estimates) has met with scorn and shields at every juncture, and now, with the Department of Justice weighing in with antitrust concerns regarding the takeover, it appears that Ellison's quixotic vision quest has finally come to an end.

Of course, with Ellison, you never know whether it's really over until he turns his attention elsewhere. And guessing where Ellison will direct his considerable arsenal next is a favorite parlor game in tech circles these days.

In many ways, it's the opposite of the game so aptly described by my colleague Paul LaMonica a couple of weeks ago: guessing what Microsoft will do with its $50 billion war chest. LaMonica rightly chided the company for not doing something with its money. Here Ellison wants to buy something, but he just can't seem to make it happen.

Where might he turn his attention?

Keeping this in mind, I spoke with a few industry analysts and observers to get a sense of where Ellison might take aim next. Few seemed to think he'd simply retreat to Redwood Shores to lick his wounds, but opinions were mixed as to what the next logical move would be.

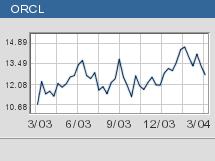

Even with the Justice Department's opposition, don't expect Oracle (ORCL: Research, Estimates) to give up its fight for PeopleSoft just yet. Though its persistence is likely futile, Oracle's continuing efforts aren't the result of typical Ellison bullheadedness.

It's actually a smart way for Oracle to gauge where it can turn its acquisitive attentions, to learn more about what the department will and will not tolerate as far as antitrust issues are concerned -- what its pain points are.

In essence, this experiment could tell Oracle "what would be an acceptable company to buy," says Jim Mendelson, an enterprise software strategist with Schwab Soundview Capital Markets.

Investors should note that all the analysts I talked with said they think Oracle has suffered minimal damage in its PeopleSoft takeover attempt. They acknowledged that SAP probably won the fight, though, since it was the only major human-resources software vendor outside the fray and as such could reassure potential customers that it wouldn't be going anywhere anytime soon.

Oracle could move in one of two directions with its next acquisition plan. It could continue to chase after the applications market, where you'll find companies such as Siebel.

Or it could bolster its position on the systems level, going for the guts of the enterprise instead of entering the software-applications sphere. Reaction among company observers was split pretty evenly over which makes more sense for Oracle to pursue.

A possible target

The one company name that came up in every discussion as a possible next target was BEA. The company makes system-level infrastructure software to help link disparate enterprise computer systems.

| Recently in Tech Biz

|

|

|

|

|

According to IDC, both BEA and IBM are the leaders in the space, each holding about 27.5 percent of the market. But I'm not so sure Oracle would be wise to go after BEA. It's clearly a successful company and would fit nicely within Oracle's product portfolio, but I think a BEA-Oracle merger would be viewed negatively by the DOJ, since it would have the same market-contracting effect that was a concern in the PeopleSoft case.

This is where, by continuing its PeopleSoft efforts, Oracle could determine the likelihood of the DOJ green-lighting a BEA-type purchase.

Should Oracle decide it wants to bolster its applications revenues (the original goal of the PeopleSoft campaign), the likely candidate -- and the one that has people's tongues wagging -- would be Siebel.

"Everyone knows there's no love lost between Larry Ellison and Tom Siebel," Mendelson says. Going after Siebel would be a very public, nasty fight for Ellison. He's proven that he's not opposed to those kinds of fights -- in fact, some would say he relishes them.

One thing's certain: If Oracle decides it wants to become an applications company, it will have a long, hard road ahead of it, with Microsoft expected to enter this space in a big way in the future.

"Trying to buy PeopleSoft was the second-best option for Oracle," says Richard Davis, an analyst with Needham & Co. "The best option is for Oracle to become a successful infrastructure firm. Go horizontal and be dominant in infrastructure, instead of going up the stack into applications."

Sign up to receive the Tech Investor column by e-mail.

Plus, see more tech commentary and get the latest tech news.

|